Earnings | NGI All News Access | NGI The Weekly Gas Market Report

DTE Earnings on Target as Haynesville Natural Gas Gathering Project Nears In-Service

Favorable weather and cost-saving measures have positioned DTE Energy Co. to achieve its previously announced earnings target of $1.25-1.30 billion this year, with several of the Detroit-based company’s businesses on track to come in on the higher end of projections despite the Covid-19 pandemic.

“It is great to be part of such an amazing team that responded so well and achieved so much in this crisis,” CEO Jerry Norcia said Tuesday on a second quarter 2020 earnings call.

More than 5,000 DTE employees have been working from home since March as part of the company’s efforts to mitigate the Covid-19 crisis. “This may be the new normal, or a better normal,” the CEO said.

DTE is executing on a plan it outlined in April to mitigate the “significant” weather challenges experienced earlier in the year, namely a mild winter, as well as Covid-19. In addition to the cost-saving measures it implemented, including a $2.5 billion cut in operations and maintenance spending, DTE is seeing electric load recovery track better than forecast with advanced metering technology indicating a return to 90% of pre-Covid-19 budgeted sales on the commercial side and 95% on the industrial side. Recent acquisitions also are driving improved earnings for the company’s natural gas storage and pipelines segment.

“Weather has provided a strong tailwind, and our non-utility businesses each continue to perform at or above the original plan,” Norcia said. “With all of these extraordinary efforts and events, we are confident in achieving our financial targets for 2020 and have positioned ourselves well for 2021.”

DTE continues to target a 5-7% operating earnings per share growth rate.

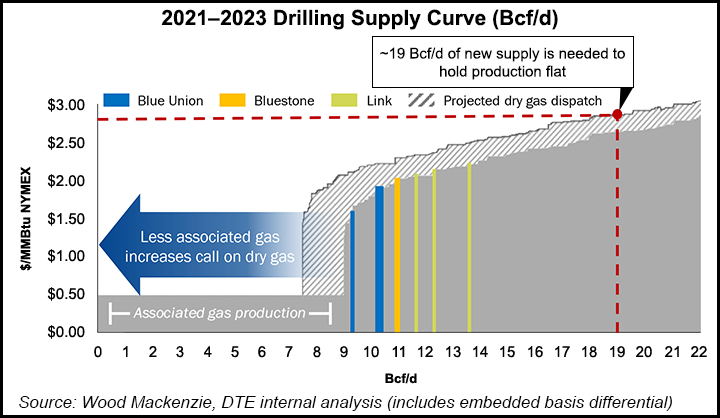

Through its midstream arm, DTE is now flowing test gas through a new 1 Bcf/d gathering system connecting Haynesville Shale supplies to growing Gulf Coast markets.

Norcia said the 150-mile, 36-inch diameter Louisiana Energy Access Project (LEAP) gathering system, which is fully contracted under long-term, demand-charge agreements, is expected to be fully in service Aug. 1.

DTE acquired the LEAP system, and other assets, from Momentum Midstream LLC and private Haynesville producer Indigo Natural Resources LLC, in a $2.65 billion deal last October.

“This is a very significant accomplishment in today’s environment,” being able to construct the pipeline “on time and on budget,” said Norcia.

Calling LEAP a “great addition to our portfolio,” Norcia noted that all of DTE’s assets are located in “strategic, well-positioned locations, creating great opportunity for future growth.” The firm’s counterparties continue to perform on plan, he said, and all of DTE’s positions are “highly hedged over the next couple of years and have minimal near-term maturities.”

In addition to Michigan’s producing basins, DTE has held assets in other gassy Lower 48 basins, including the Barnett Shale in North Texas. It also has a foothold in the Appalachian Basin.

Regarding the recent cancellation of the Atlantic Coast Pipeline (ACP) by Dominion Energy Inc. and Duke Energy Corp., Norcia said the project’s scrapping bodes well for its Link and Nexus Gas Transmission assets in Appalachia.

“The Atlantic Coast Pipeline kind of draped over our Link assets, and some of our shippers we’re counting on ACP to move their volumes East. I think that certainly becomes a fundamental outlet for some of those customers in that region,” the CEO said. “Getting that gas to market positions Nexus quite well for that. So we continue to see more and more activity on Nexus, which is positive.”

Nexus has about one-third of the pipeline’s capacity not yet under long-term contract, but Norcia said it continues to see more customers transition from “seasonal contracts to contracts that push beyond one year. We’ve actually seen some favorability in pricing as well.”

DTE also brought online Michigan’s largest wind park, with 68 turbines generating 168 megawatts (MW) of energy. The Polaris Wind park is the first of four new wind parks the company is expected to commission this year, with plans to file later this summer for the regulatory approval of another 400 MW of renewable energy.

DTE in 2018 set a goal to reduce methane emissions by 80%, with the company’s gas utility in June also committing to a goal of net zero carbon emissions by 2050. The greenhouse gas (GHG) reduction goals include partnering with customers to address up to 100% of the natural gas carbon footprint with programs that encourage energy efficiency and participation in a voluntary emissions offset program. The roadmap to achieve net-zero emissions also would include suppliers and the gas unit’s operations.

DTE reported second quarter earnings of $277 million ($1.44/share), up from $182 million (99 cents) in 2Q2019. Operating earnings were $295 million ($1.53), a gain of $112 million from last year.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |