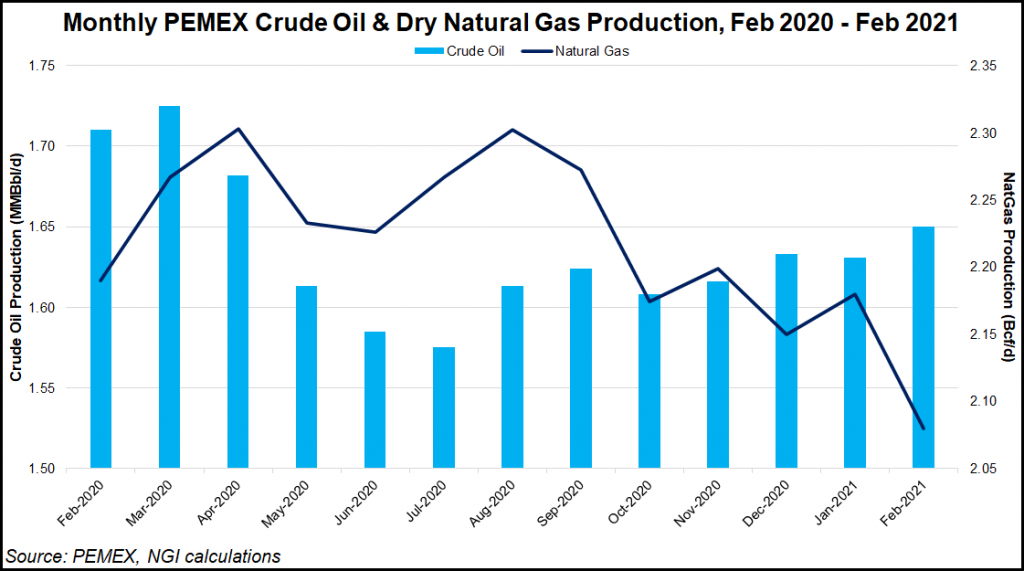

Mexican national oil company Petróleos Mexicanos (Pemex) reported a decline in dry natural gas output from its processing centers but an increase in fuel oil production from its refineries in February.

Dry natural gas production averaged 2.08 Bcf/d for the month, down from 2.18 Bcf/d in January and 2.19 Bcf/d in February 2020.

Fuel oil output rose month/month for a third straight time to average 248,100 b/d, well above the 2020 full-year average of 176,000 b/d.

A recently passed law in the power sector has been criticized as an attempt to ensure that fuel oil produced by Pemex is purchased and burned by state power utility Comisión Federal de Electricidad (CFE).

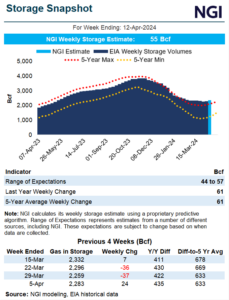

Mexico’s total natural gas production, meanwhile, averaged 3.8 Bcf/d in February, compared to 3.84 Bcf/d in...