E&P | NGI All News Access | NGI The Weekly Gas Market Report

Drillers Still Rushing Back, But Some Analysts Foresee Slowdown

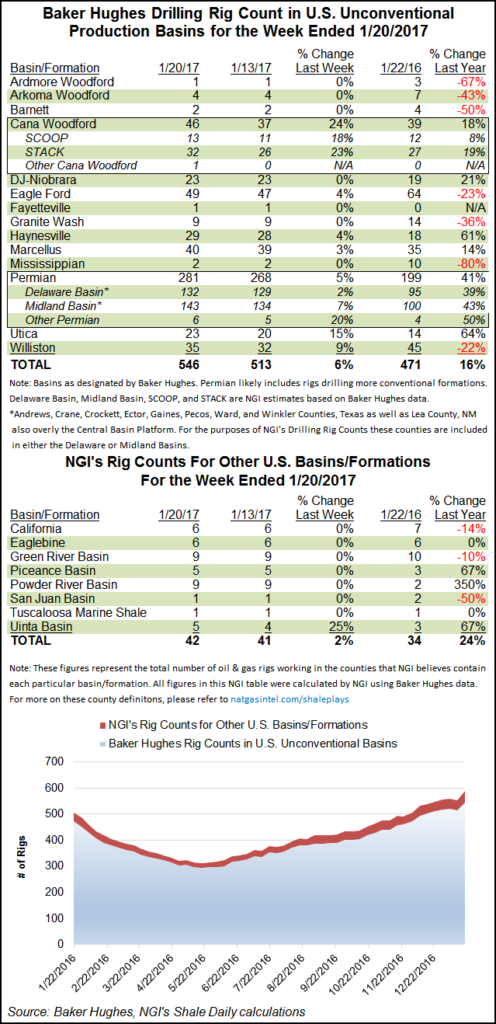

The weekly rig count tallied by Baker Hughes Inc. (BHI) once again packed a Permian punch on Friday as 13 rigs returned to the oil-rich West Texas and New Mexico play.

Texas gained 17 rigs during the week, and Oklahoma added seven as the overall land count shot up by 36 units to 670, now well past the year-ago tally of 607. Oklahoma is home to the Cana Woodford, which saw its rig tally increase by nine units to 46, making it the second-biggest gainer among plays.

The offshore dropped one rig to end at 24 and make for an overall U.S. count increase of 35 to end at 694 active units. “The 35-rig increase this week is the fourth-largest increase on an absolute basis since the beginning of 2008, and at 5.3% it is easily the largest week/week percentage increase over that time. The second-highest was 4.5%,” said Patrick Rau, NGIdirector of strategy and research. Improving drilling economics along with drilling budgets that are larger this year are helping to support the comeback, Rau said.

Twenty-nine U.S. oil rigs came back along with six natural gas units. One directional, 22 horizontals and 12 verticals returned.

In Canada drillers continued rushing back to the patch to beat spring break-up. Canada gained 27 rigs to end at 342 active. Twenty-three oil and five natural gas rigs came back while one “miscellaneous” rig departed.

In a note Wednesday, analysts at Jefferies said they are raising their medium-term U.S. land rig count assumption to 825 from 710 this year and to 1,120 from 984 for 2018. However in the same note they wrote that the land rig recovery could stall by mid-2017.

“Our analysis points to a risk of deceleration in rig count growth through 2017, including the possibility of the rig count potentially stalling by mid-’17,” they said. “We can think of three reasons why such a stall may occur.”

Jefferies analysts suggested that U.S. onshore oil production could rebound faster than expected. “We also sense that U.S. Lower 48-focused E&Ps may be close to their targeted activity levels associated with their preliminary 2017 production plans,” they said.

Another potential weight on the climbing rig count could be a shortage of hydraulic fracturing horsepower as well as proppant sand. And then oilfield services pricing could rise faster than anticipated, placing another drag on growing rig deployment.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |