Bakken Shale | E&P | Eagle Ford Shale | Haynesville Shale | Marcellus | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin | Utica Shale

Drill, Baby, Drill — Faster Still

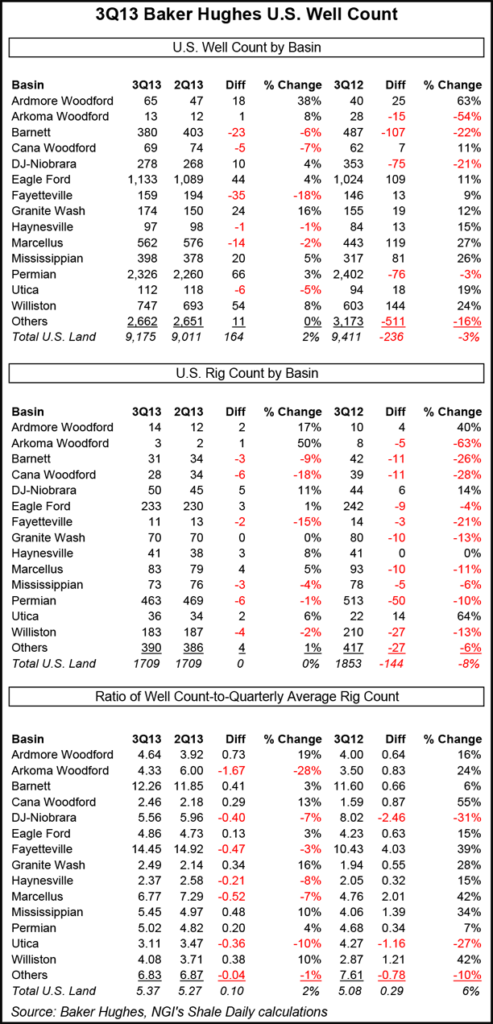

The average U.S. onshore drilling rig is producing 2% more wells than it did three months ago, and increasingly, rigs are targeting liquids-rich plays over those known for producing dry gas, according to Baker Hughes Inc.

Baker’s onshore Well Count for the third quarter reported 9,175 wells, an increase of 164, or 2%, from the revised second quarter count of 9,011 wells.

“Compared to the third quarter of 2012, the count was down 236 wells, or 3%,” Baker said. “Due to improved drilling efficiencies, the average U.S. onshore drilling rig is now producing 2% more wells, compared to only three months ago.”

Compared to the second quarter of 2013, the well count increased most notably in the Permian Basin (up 66 wells, or 3%), Williston Basin (up 54 wells, or 8%) and the Eagle Ford Shale (up 44 wells, or 4%). The increases were offset by reductions in the Fayetteville Shale (down 35 wells, or 18%) and Barnett Shale (down 23 wells, or 6%) (see chart).

The average U.S. onshore Rig Count for the third quarter was unchanged from the previous quarter at 1,709 rigs. On average, the U.S. onshore rig fleet produced 5.37 new wells during the third quarter, representing a 2% improvement in drilling efficiencies compared to the second quarter.

As new drilling technologies and methodologies are introduced to the unconventional market, there is a continual evolution of drilling efficiencies. Baker’s Well Count provides a greater understanding of key market forces, capturing the number of wells that were spud in each major U.S. basin. When combined with the Baker Hughes Rig Count, drilling efficiencies can be tracked by basin.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |