Infrastructure | NGI All News Access | NGI The Weekly Gas Market Report

Dominion ‘Going to Get Our Share’ of Marcellus Buildout

Dominion CEO Tom Farrell says his company’s pipeline infrastructure makes up “the spine of the Marcellus/Utica shale.” On Monday he outlined how Dominion is working a slate of producer-push and market-pull infrastructure projects to meet the region’s continually growing demand for takeaway capacity.

“There’s a lot of infrastructure demand to get the gas out of the Marcellus and Utica region,” Farrell said during a meeting with financial analysts following the company. “We’re obviously not going to get all of this, but we’re going to get our share of it.”

For instance, the company is about midway through a package of producer-push projects, what it calls “producer outlet projects.” Dominion started with nine projects and completed the first five of them last year. These were small affairs costing a combined $100 million. The four remaining projects will cost about $400 million. “All will come online next year,” Farrell said.

“And then on our drawing board in various stages of development and negotiation is another $500 million of what we call producer outlet projects, driven by producers who want to get the gas out to market. We expect to spend over the course of [our] six-year plan, about $900 million in total capex on producer outlet projects and related projects.”

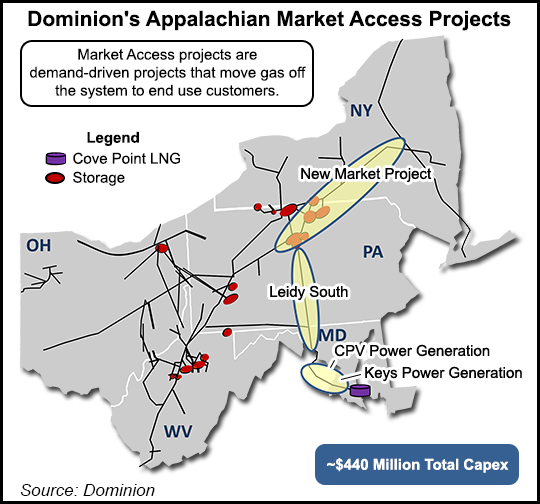

On the demand side, Dominion is pursuing a slate of market access projects to serve gas and power utilities and/or power generation demand. The company’s three projects are Leidy South, CPV Power Generation and Keys Power Generation. The three are expected to cost the company about $440 million. Farrell said he expects to see more gas-fueled power generating capacity in the region and potentially more pipeline capacity to serve it.

The big project on the Marcellus/Utica plate, though, is the Atlantic Coast Pipeline (ACP), of which Dominion has a 45% stake. Its partners are Duke Energy, Piedmont Natural gas and AGL Resources. ACP is planned to have a capacity of 1.5 Bcf/d, but Farrell said Monday he thinks there is “a very good chance” it will grow to 2 Bcf/d with additional compression when all is said and done. The total cost is slated at $4.5-5 billion, with another $500 million or so for compression to bring capacity up to 2 Bcf/d. In-service is expected during November 2018.

A complement to ACP is Dominion’s DTI Supply Header with capacity of 1.5 Bcf/d. Its capacity is planned to serve the ACP partners and other local distribution companies. In service of the $500 million project is expected during November 2018 to coincide with ACP.

“There’s a lot to be done in the Marcellus and Utica shales, and we have done a lot about it,” Farrell told analysts. Spectra Energy Corp. is another pipeline operator that recently talked up its share of projects in the Marcellus/Utica with analysts (see Daily GPI, Feb. 6).

Also on Monday, Dominion disclosed its performance projections for master limited partnership Dominion Midstream Partners LP. Dominion Midstream is targeting an average compounded annual growth rate of 22% for its cash distributions from 2015 through the end of the decade. The growth policy would result in an annualized cash distribution rate of 85 cents/unit by year-end 2015. All cash distributions are subject to quarterly declaration by the board.

“We are confident in our ability to acquire interests in businesses through dedicated dropdowns from Dominion or by other means that will produce sufficient cash flows to support best-in-class cash distributions,” Farrell said. “These are businesses that are federally regulated or have long-term contracts with little commodity risk.”

Dominion reported operating earnings for 2014 of $2 billion ($3.43/share) compared to $1.9 billion ($3.25/share) for the same period in 2013. Operating earnings are defined as reported earnings, determined in accordance with Generally Accepted Accounting Principles (GAAP), adjusted for certain items. Unaudited reported (GAAP) earnings for 2014 were $1.3 billion ($2.24/share) compared with $1.7 billion ($2.93/share) for the same period in 2013.

The main differences between GAAP earnings and operating earnings for the full year 2014 include a charge associated with Virginia legislation permitting recovery of costs related to the development of a third nuclear unit at North Anna and offshore wind facilities through base rates; call premiums on early debt redemptions associated with liability management; a charge related to a settlement offer to incur future ash pond closure costs at certain utility generation facilities; and charges related to the repositioning of the company’s producer services business.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |