Markets | NGI All News Access | NGI The Weekly Gas Market Report

Domestic Natural Gas Spot Prices Average 21% Higher in 2017, FERC Says

Natural gas spot prices in the United States were up an average 21% last year compared with 2016, and a confluence of events helped drive prices in Southern California 18% higher as well, according to FERC.

But 2017 Henry Hub prices remained 7% lower than the five-year average and 33% lower than the previous 10-year average, the Federal Energy Regulatory Commission said in its annual State of The Markets Report, which was issued Thursday.

Cold weather and high winter heating load at both the beginning and end of 2017 contributed to a 28% price increase in the East, and prices in the Marcellus Shale region jumped 19% as new pipeline capacity allowed producers to meet a larger share of demand in previously inaccessible market areas, according to the report.

Pipeline projects for Appalachia certificated by FERC in 2017 included Nexus Gas Transmission, Mountaineer Xpress and Rover Pipeline, which at 3.25 Bcf/d is the large single pipeline ever certificated by the Commission.

New pipeline activity in Appalachia has continued in 2018. TransCanada Corp. placed the Leach XPress project into service Jan. 1, adding up to 1.53 million Dth/d of capacity from the region. The project includes 160 miles of 36-inch diameter pipeline, three compressor stations and modifications to an existing compressor station. Two days later, FERC issued certificates of public convenience and necessity for the Mountaineer XPress and Gulf XPress projects, a pair of TransCanada efforts to increase natural gas pipeline capacity out of the Appalachian Basin by expanding the Columbia Gas Transmission LLC’s system.

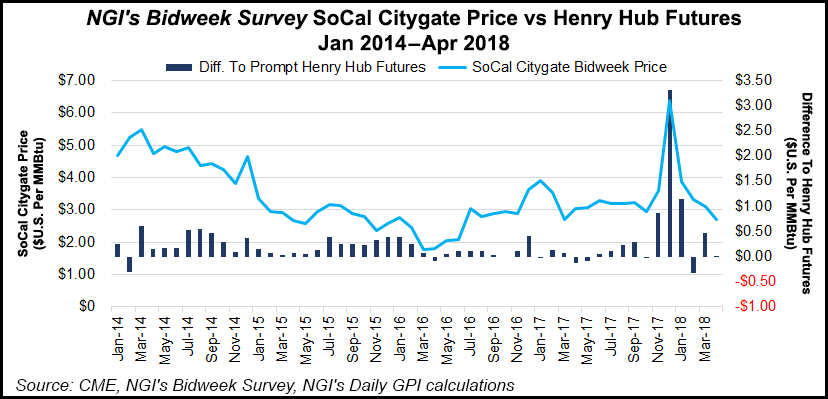

Pipeline and storage limitations in Southern California continued to constrain the Los Angeles market area and prices there increased 18% compared with 2016. Central to the area’s energy headaches has been the Aliso Canyon underground natural gas storage facility, which suffered the largest methane leak in U.S. history in November 2015 and has been effectively shut down for more than two years. The root cause of the methane leak remains under investigation.

Next-day prices measured at the SoCal Citygate remained within their five-year average for most of 2017, but storage limitations at Aliso Canyon, combined with pipeline issues along the SoCalGas system and colder-than-normal temperatures prompted price increases late in the year, FERC said. The SoCal Citygate price set a record high on October 24.

Those same tumbling temperatures just before and after New Year’s Eve led to the largest storage withdrawal in history of 359 Bcf for the week ending Jan. 5 that easily toppled the previous record of 288 Bcf set in January 2014.

“Average heating degree days in December 2017/January 2018 were 14% larger than December 2016/January 2017 and 2% larger than the five-year average for December/January,” FERC said.

Large winter withdrawals helped push storage inventories to 1.35 Tcf on April 5, the lowest end-of-winter storage figure since 2014.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |