NGI The Weekly Gas Market Report | Infrastructure | NGI All News Access

DOE Highlights Case for Appalachian NGL Storage Hub in Report to Congress

The Department of Energy (DOE) on Tuesday unveiled a long-awaited report demonstrating the feasibility of developing a natural gas liquids (NGL) storage hub in the Appalachian Basin that it says would increase supply and geographic diversity for the nation’s petrochemical and plastics industries.

In remarks before the National Petroleum Council’s annual meeting in Washington, DC, DOE Secretary Rick Perry also said that the Trump administration would support the development of an Appalachian hub to strengthen the country’s energy and manufacturing security.

“There is an incredible opportunity to establish an ethane storage and distribution hub in the Appalachian region and build a robust petrochemical industry in Appalachia,” Perry said. “As our report shows, there is sufficient global need, and enough regional resources, to help the U.S. gain a significant share of the global petrochemical market.”

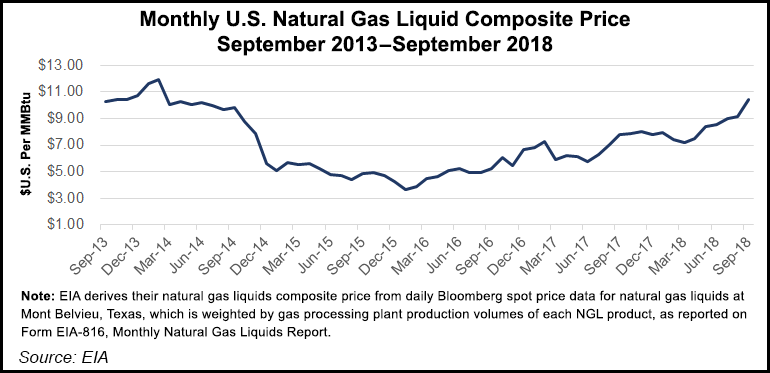

With large NGL hubs in Mont Belvieu, TX, on the Gulf Coast, Conway, KS, and Sarnia, Ontario, North America has the world’s second largest ethylene production capacity behind the Asia-Pacific region, DOE noted in its report. But with 95% of U.S. capacity located in Texas and Louisiana, DOE added that the geographic concentration may pose a strategic risk, especially when severe weather events limit the availability of key feedstocks, as Hurricane Harvey did last year.

The geographic diversity of a possible hub in Appalachia, where NGL production is expected to continue growing, “could provide manufacturers with flexibility and redundancy with regard to where they purchase their feedstock and how it is transported to them,” the report said. “Moreover, this flexibility and redundancy, as well as the overall increase in U.S. feedstock production, could mitigate the potential for any price spikes in petrochemical feedstocks that could be caused by a severe weather or other disruptive event in any one region of the U.S.”

U.S. natural gas plant liquids, according to the report, are expected to nearly double between 2017 and 2050, supported by an increase in global petrochemical demand. The bulk of that growth is expected to come from the Marcellus and Utica shale plays, along with production from the Permian Basin in West Texas and southeastern New Mexico, over the next decade. Ethane production in Appalachia alone, DOE said, is projected to reach 640,000 b/d through 2025 — or more than 20 times higher than it was just five years ago.

Jerry James, who co-founded Shale Crescent USA in 2016 to brand the industry’s potential in the Mid-Ohio Valley in Ohio, Pennsylvania and West Virginia, said the DOE report “solidifies the notion that diversifying America’s petrochemical manufacturing base” by investing in an Appalachian NGL hub would improve the nation’s competitive edge.

“As we watch hurricanes threaten Gulf Coast production, the Shale Crescent region offers a more insulated, affordable alternative to supplement production,” said James, who is also president of Ohio-based Artex Oil Co. “This will ultimately prevent disruptions in the nation’s supply chain and keep prices stable for many plastic-based goods we rely on every day.”

The Gulf Coast is unequivocally North America’s petrochemical stronghold, and industry representatives in the Northeast have widely acknowledged that. In Mont Belvieu alone, there is more than 240 million barrels of NGL storage that serves a concentrated energy value chain.

The DOE report notes, however, that one-third of U.S. petrochemical activity occurs within 300 miles of Pittsburgh, with more than $300 million of net revenue, 900,000 workers and 7,500 related establishments.

As a result, the report makes clear that development of an Appalachian hub might not necessarily conflict with the Gulf Coast’s hub and the expansion that’s underway there. Most Appalachian capacity, the report said, would likely serve regional demand for NGL derivatives, freeing up Gulf Coast production for other markets, including exports.

Marcellus Shale Coalition President David Spigelmyer said the industry in the Northeast remains “fully committed” to working collaboratively with policymakers “at every level of government” and all other key stakeholders to help grow energy jobs in the basin. He also welcomed the Trump administration’s support for such efforts.

Proponents of an NGL storage hub want to link up Appalachian shale formations with a network of pipelines, equipment and underground storage. The hub, supporters say, could ease supply and demand imbalances and help create more regional buyers and sellers of the commodities, similar to Mont Belvieu.

To be sure, dry gas storage is nothing new in Appalachia, which has long been a staging ground to move volumes to the Northeast. Salt solution mining has also occurred for decades in the region, and there are currently shallower mined hard rock facilities that store refined products and NGLs across the basin.

But the region still lacks adequate NGL infrastructure for such a robust hub.

“The extent to which east region NGLs will be converted and consumed locally will depend on regional infrastructure additions and, more specifically, the interplay between storage and transportation,” DOE said.

Mountaineer NGL Storage LLC is currently working through a prolonged regulatory process in Ohio to develop an underground facility in the Salina salt formation there. Appalachia Development Group LLC also is working to secure financing for a similar facility in West Virginia.

The DOE’s report is the latest in a series of private and public sector efforts in Appalachia to demonstrate the potential for a storage hub. In recent years, other studies have been released showing that tens of billions of dollars in investments would come with such infrastructure and how the region has distinct advantages compared to the Gulf Coast.

“The right policies will be critical to realizing the opportunity. Policymakers can help by continuing to ensure that natural gas liquids storage and distribution projects are eligible for existing private-public financing programs,” the American Chemistry Council said. As Congress and the Trump administration “consider infrastructure modernization legislation, the Appalachian Hub should be a priority. And a timely and efficient regulatory permitting process is essential.”

Another study from West Virginia University last year showed that Appalachia is ripe for the kind of underground NGL storage that would help tame production volatility, identifying various formations throughout the region that are suitable for the task.

Moreover, a unit of Royal Dutch Shell plc is currently building a multi-billion dollar ethane cracker in Western Pennsylvania that’s expected to come online in the early 2020s. Thailand’s state-owned PTT Global Chemical pcl, meanwhile, is thought to be close to making a final investment decision on a similarly-sized ethane cracker in nearby Ohio.

“The petrochemical industry is going to be the next big thing to come to Appalachia,” said Energy In Depth spokesman Dan Alfaro, who works in the region for the outreach arm of the Independent Petroleum Association of America. “Shell’s investment was the first big step in this movement, and we’re going to continue to see more of these investments coming into the region in the near future.

“The supply is here, the demand is here, the necessity is here and the report shows Appalachia checks all the boxes to make the region a viable location to house the next American energy hub.”

DOE prepared its report at the request of Congress and shared the findings with a select group of lawmakers. The analysis considered projected trends in ethane production over the coming decades and where changes in ethane production are expected to occur, with a particular focus on regions where established ethane hubs don’t exist.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |