E&P | NGI All News Access | NGI The Weekly Gas Market Report

Devon Takes $553M for Slice of Barnett Shale

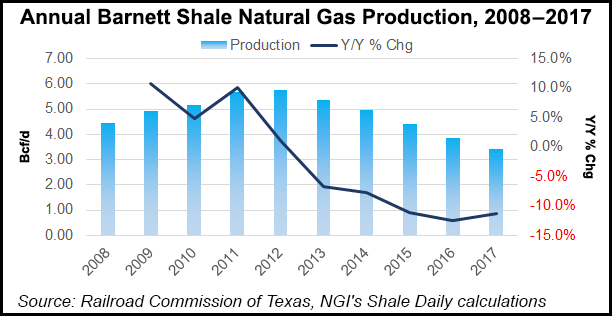

Devon Energy Corp. is selling a piece of the Barnett Shale, the onshore play that brought it to the dance, for $553 million.

The buyer was not disclosed; the transaction is expected to be completed by mid-year.

“Combined with other recent asset sales, divestiture proceeds associated with our 2020 Vision have now reached $1 billion,” said CEO Dave Hager.

The 2020 Vision plan launched last year involves a strategic turn from growing at any cost toward delivering more value to investors. Devon is marketing up to $5 billion of its assets, which since last year have included selling off property in the Eagle Ford Shale.

The Barnett sale, which represents about 20% of Devon’s North Texas portfolio, has been in the works since last summer.

Net production from the acreage being sold, primarily wells in Johnson County, currently is averaging 200 MMcfe/d. Field-level cash flow accompanying the assets, which excludes overhead costs, is expected to be about $100 million this year.

Devon still has a substantial Barnett foothold that runs across Denton, Wise and Tarrant counties, which is producing around 680 MMcfe/d. The position includes an inventory of about 1,500 potential locations, with undrilled inventory and horizontal refracturing opportunities, management said.

Devon in 2002 purchased Mitchell Energy & Development Corp. for what now is considered a bargain price of $3.1 billion, which included the then-emerging Barnett Shale, the granddaddy of unconventional basins. Pioneer George Mitchell and his team crafted unconventional drilling techniques in the Barnett, which Devon honed to advance hydraulic fracturing and horizontal drilling.

In conjunction with the Barnett sale, Devon’s board has authorized a $1 billion share repurchase program and a 33% increase in the quarterly cash dividend.

“We are very confident about Devon’s future and, as market conditions permit, we will continue to pursue opportunities to further increase cash returns to our shareholders,” Hager said.

For the Barnett sale, J.P. Morgan Securities LLC acted as the financial adviser while Vinson & Elkins LLP acted as legal adviser.

Analysts warmed to the news of the sale and stock purchase.

Tudor, Pickering, Holt & Co. (TPH) indicated the sale was to a private equity company. Analysts said the Johnson County sale, share repurchase and dividend boost “illustrate mounting evidence” that exploration and production (E&P) companies “are actually serious about improving cash returns to shareholders.”

It also shows that there is “interest of private capital in acquiring acreage positions, which are no longer core within the portfolios of publicly traded E&P operators.” The sale also eased investor concerns with a “decent price tag,” and implied the acreage went for around $2,800/acre per flowing Mcfe/d.

“The dividend increase puts the payout at the midpoint of management’s desired 5-10% of cash flow range and share repurchase is timely, as the stock sits in earshot of its 2016 lows,” said TPH analysts.

“We look to another $3-4 billion of value from the remaining Barnett and Eagle Ford assets over the medium-term.”

BMO Capital Markets analyst Phillip Jungwirth said the sale met expectations and “builds credibility” toward Devon’s aim to sell more than $5 billion of assets.

Regarding the share repurchase plan and dividend bump, Jungwirth said at the current stock price, the share repurchase “equates to 6% shares outstanding (2% of volume using 50-day average over year).

“We estimate the $1 billion share repurchase program leaves significantly financial flexibility…” and “additional asset sales would improve leverage further.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |