Shale Daily | E&P | Eagle Ford Shale | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

Devon Reduces Costs, Increases Output in Permian, Eagle Ford

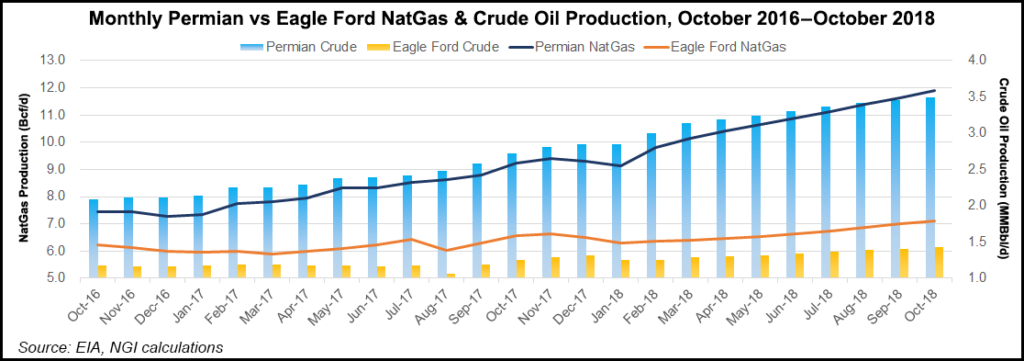

The Permian Basin and Eagle Ford Shale drove Devon Energy Corp.’s production performance during the third quarter, even as upstream spending fell 9% below guidance.

The Oklahoma City-based independent’s performance “was highlighted by improving well productivity and capital efficiency that drove U.S. production above the high end of guidance with a total capital investment well below forecast,” CEO Dave Hager said during a conference call to discuss results.

Total production averaged 522,000 boe/d, with oil and liquids volumes increasing to 67% of the product mix, a sharp reversal from the formerly natural gas heavy. U.S. resource plays that averaged 418,000 boe/d, exceeding guidance when adjusted for asset sales of 398,000-417,000 boe/d.

Within the diversified U.S. portfolio, the strongest asset-level performance was achieved in the Permian Delaware in southeastern New Mexico. Oil production increased 45% year/year, driving Delaware volumes to 79,000 boe/d. Among the highlights were seven Wolfcamp formation wells in the state-line area that averaged initial production (IP) rates over 30 days of 4,000 boe/d per well.

Operations chief Tony D. Vaughn, who joined Hager on the conference call, said the Delaware assets had “reached an inflection point with the massive improvement in well productivity achieved in 2018. While our Wolfcamp wells stole the headlines this quarter with IPs reaching 4000 boe/d, our Bone Spring and Leonard programs have also consistently levered outstanding results this year.

“In aggregate, between these three prolific formations, our average well productivity in the Delaware has improved by more than 70% in 2018 compared to legacy activity in the area…Importantly, we are well positioned to accelerate Delaware Basin activity in the fourth quarter and into 2019 to further exploit the advantage these top-tier assets provide.

This plan will result in higher 2018 exit rate targets and will deliver around 40% oil growth in 2019.”

The Eagle Ford assets in South Texas also delivered, posting 12% sequential production growth, driven by 20 wells brought online with average IPs of 3,000 boe/d per well.

Devon is on track to advance its U.S. light oil growth by 17% year/year, Hager said. The growth rate is trending at about 200 basis points above the original budget, adjusted for asset sales.

While production grew, upstream capital expenditures (capex) declined to $523 million in the third quarter, 9% below midpoint guidance. For the full year, Devon has made no modifications to its capex and expects spending to remain about $2.4 billion.

Devon has set a tentative 2019 capex plan of $2.4-2.7 billion, with the Permian Delaware to receive the bulk of the funds “by a wide margin, with investment increasing by greater than 25% to nearly $1 billion,” Hager said.

“The increased activity in the Delaware is an easy capital allocation decision, given the massive step change improvement in well productivity and returns we have experienced over the past year. Importantly, we have secured the supply chain infrastructure and takeaway capacity to execute on our development plans.”

Beyond the Delaware, Oklahoma’s STACK, aka the Sooner Trend of the Anadarko Basin, mostly in Canadian and Kingfisher counties, along with the Rockies “will also be important growth assets for us in 2019,” he said. “With our refined approach to infill spacing, we expect the STACK to be our second highest funded asset in 2019 and doubling of activity of the Rockies will also contribute to our oil growth initiatives.”

Capital spending in 2019 “is expected to drive 15-19% oil growth from the retained U.S. assets. Net earnings climbed to $2.5 billion ($5.14/share) in 3Q2018, versus year-ago profits of $193 million (37 cents). Operating cash flow from continuing operations totaled $807 million, a 61% increase from 3Q2017. The operating cash flow also funded total capex and generated $249 million of free cash flow.

Upstream revenue, excluding derivatives, totaled $1.6 billion in 3Q2018, a 29% improvement from a year ago. Contributing factors were higher commodity prices and growth in higher-margin, liquids production.

Revenue associated with natural gas liquids (NGL) production delivered the highest growth, advancing 134% from 3Q2017. NGL volumes benefited from direct access to the Mont Belvieu fractionator near Houston, management said.

Also contributing to higher revenues were firm transport and marketing agreements that provide most of the U.S. oil production direct access to Gulf Coast pricing. Combined with price protection provided by regional basis swaps, U.S. oil realizations averaged about 97% of the West Texas Intermediate benchmark.

The company generated additional cash flows during 3Q2018 through its ongoing divestiture activity, including completion in July of the $3.1 billion EnLink Midstream transaction. Asset sale proceeds exceeded $3 billion in 3Q2018. The company expects to achieve its $5 billion divestiture target by early 2019.

To date, Devon has repurchased 67 million shares, or nearly 13% of outstanding shares, at a total cost of $2.7 billion. A $4 billion share-repurchase program is set for completion in early 2019.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |