Shale Daily | E&P | NGI All News Access | NGI The Weekly Gas Market Report

Devon Exiting Canada in $2.8B Sale to Canadian Natural

Oklahoma City-based Devon Energy Corp., whose fortunes today are trained on Lower 48 oil prospects, is selling its Canadian business for $2.8 billion (C$3.8 billion) to Canadian Natural Resources Ltd.

The asset base, mostly in Alberta, is 100% operated thermal in situ production, as well as 95% operated heavy oil production, both adjacent to existing Canadian Natural assets. Additionally, the assets include 1.5 million acres, of which one million acres are undeveloped.

“These high quality assets complement our existing asset base and provide further balance to our production profile, while not increasing the need for incremental market access out of Western Canada, as it is already existing production,” Canadian Natural President Tim McKay said.

The assets also give Canadian Natural an opportunity “to add value through synergies, including facility consolidation and operating and marketing efficiency opportunities, with targeted benefits of C$135 million on an annualized basis.”

With the Devon assets in hand, Canadian Natural expects to exit 2019 at 250,000 b/d of thermal in situ production, 450,000 b/d of oilsands mining and upgrading production, as well as 150,000 b/d of conventional light crude oil and liquids production.

“The sale of Canada is an important step in executing Devon’s transformation to a U.S. oil growth business,” said CEO Dave Hager. “This transaction creates value for our shareholders by achieving a clean and timely exit from Canada, while accelerating efforts to focus exclusively on our high-return U.S. oil portfolio.”

Hager expressed appreciation to the Canadian workforce, which has helped to build a heavy oil business for two decades. Devon sold its conventional oil and gas portfolio in Canada five years ago.

“With this change in ownership,” Hager said Wednesday, “it is great to see our talented and innovative employee base transition to a top-tier company like Canadian Natural Resources.”

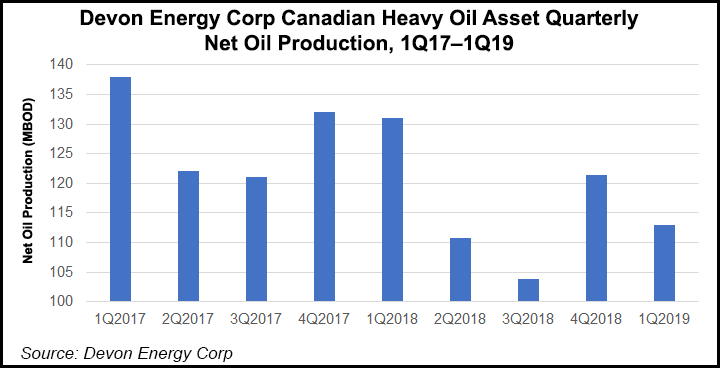

Devon’s Canadian asset portfolio principally is in Alberta, with net production averaging 113,000 boe/d in 1Q2019. At year-end 2018, proved reserves were approximately 409 million bbl. Field-level cash flow excluding overhead costs totaled $236 million in 2018.

To complete the transformation to an onshore U.S. oil growth business, Devon still is looking to sell its Barnett Shale natural gas assets in North Texas. Data rooms were opened, and the company expects to divest the portfolio by year’s end.

Devon has increased its projections for Lower 48 oil production growth for 2019 to 17% from 2018, up 200 basis points from previous guidance, on improving well productivity and capital efficiencies, particularly in the Permian Basin.

J.P. Morgan Securities LLC acted as Devon’s lead financial adviser on the Canada sale and Goldman Sachs also acted as a financial adviser.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |