Markets | Natural Gas Prices | NGI All News Access

Despite Solid Storage Injection, Natural Gas Futures Find Footing as Supply Adequacy Remains in Question

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |

Markets

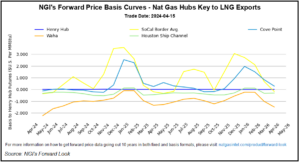

Natural gas futures jumped higher Tuesday afternoon after reports of a pipeline incident in Alberta broke up an otherwise quiet shoulder season day of trading. At A Glance: Production at 97.4 Bcf/d Weak spring season demand National Avg. back above $1 The May Nymex contract rose 4.1 cents day/day to settle at $1.732/MMBtu. Futures spiked…

April 16, 2024Mexico

Markets

By submitting my information, I agree to the Privacy Policy, Terms of Service and to receive offers and promotions from NGI.