Regulatory | Coronavirus | NGI All News Access

Despite OPEC Win, Challenges Facing Mexico Mount as Coronavirus Upends Markets

Mexico’s Energy Minister Rocio Nahle was able to score a considerable win over the weekend by negotiating down a production cut from 400,000 b/d to 100,000 b/d in emergency talks between the Organization of the Petroleum Exporting Countries (OPEC) and its allies, but the gains could be fleeting, according to analysts.

Because of Mexico’s annual hedge of its national oil revenues, the country could earn as much as $6 billion in 2020 given the gap between its hedged position and current oil prices, according to a Rystad Energy analysis.

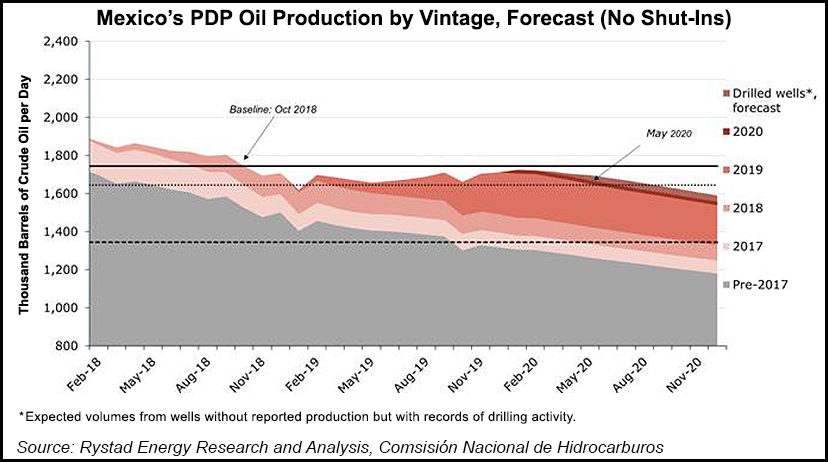

Due to the terms of the deal, it might even get away with less production loss. “If currently drilled wells come on line within schedule and no new wells are planned, Mexico would need to effectively reduce output by only 50,000 b/d in May and June,“ said Rystad Energy senior analyst Alexandre Ramos Peon.

Still, the win could be quickly forgotten given the storm of economic and health worries descending upon the country. President Andrés Manuel López Obrador has been slow to tackle the coronavirus pandemic and has shown an unwillingness to change course to address its challenges, according to Lourdes Melgar, the energy program director for the international development company DAI.

“It’s important to mention that for weeks the president denied Mexico was at risk of the pandemic. He even claimed that Mexicans had a special gene to prevent infection,” Melgar said Wednesday during a webinar organized by the Baker Institute for Public Policy’s Center for Energy Studies at Rice University in Houston.

“So, Mexico has not prepared for this. We are already seeing challenges in Tijuana and Baja California with health systems overrun. And there are no counter-cyclical policies to help Mexican society. We have to pay our taxes by the end of April and there is no support for citizens, for small and medium companies.”

The Woodrow Wilson Center’s Duncan Wood told NGI’s Mexico GPI that the difficulties facing Mexico, including an economy that could shrink by as much as 8% this year, are compounded by a lack of transparency.

“We don’t know how bad it is,” Wood said. “But anecdotal evidence is that things are going to get bad. In terms of cases and deaths, I think we are going to see Mexico hit very hard. And in terms of the economy, the economy isn’t prepared. It’s difficult for people who work informally. Beyond the immediate impact on public health, the real problem is without effective social distancing this could drag on for months and months.”

Meanwhile, López Obrador has continued his “energy sovereignty” platform as if nothing has changed, touting the building of the Dos Bocas refinery and growing domestic production at state oil company Petróleos Mexicanos (Pemex) as pillars of Mexico’s economic hopes.

“The reality is even in this crisis, he still is making ”Pemex first,’” said Melgar, who served as Deputy Minister of Hydrocarbons at the Mexican Energy Ministry from 2014-2016 and oversaw the implementation of the country’s energy reform. “He still wants Pemex to be the motor of Mexican development.”

Mexico’s oil accounts for about 8-9% of gross domestic product. About 15% of government spending comes from its oil revenues.

“But the president has this oil-view of how things should work. The key point for him is that Mexico can continue to go on with business as usual, even under this current scenario.”

After more than a decade of decline, crude oil production in Mexico rose for a fourth straight month in February, to average 1.72 million b/d, compared with 1.7 million b/d in February 2019. Natural gas production averaged 3.9 Bcf/d in February, up from 3.73 Bcf/d.

The president has promised to hit 2.7 million b/d by the end of his term in 2024.

Yet some analysts from within Mexico have argued that the OPEC cuts were a perfect opportunity for the country to save money in a sinking economy that is beginning to feel the effects of the coronavirus.

Analysis by Welligence Energy Analytics shows that 80% of Pemex’s producing fields are cash flow negative, including taxes, at a $35/bbl Brent oil price. Excluding taxes, 200,000 b/d are uneconomic.

Meanwhile the OPEC cut has barely made a dent in oil prices. On Wednesday, the benchmark for U.S. crude prices settled below $20/bbl for the first time since 2002.

“It’s surprising that all the other oil companies are redefining their business plans but not Pemex,” Melgar said.

As a result of crashing prices, for example, U.S. independents as a group have already slashed 2020 spending guidance by an estimated 30-40%.

Despite the 9.7 million b/d cut in oil production agreed to by OPEC, the International Energy Agency forecasted Wednesday that due to the economic standstill caused by the coronavirus, oil demand would fall by 23.1 million b/d in the second quarter from the year-ago period, suggesting even more cuts might be needed.

“I think Pemex can have an alternative future,” Melgar said. “Mexico needs to think to the future and not move back to the past.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |