Markets | NGI All News Access | NGI Data

Despite Headwinds, Summer Heat Props Up Weekly Natural Gas Prices

Newly intensified coronavirus outbreaks threatened energy demand, but rising summer temperatures across much of the Lower 48 boosted cash prices for the June 22-26 period.

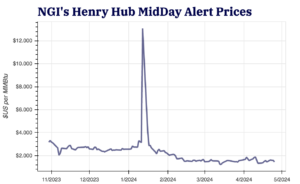

NGI’s Weekly Spot Gas National Avg. for the June 22-26 period climbed 9.5 cents to $1.520.

Stronger summer conditions took hold during the week – following a relatively mild stretch the prior week – particularly on Monday, when extreme heat gripped California and parts of Texas. More widespread heat is forecasted for July, Bespoke Weather Services said, fueling anticipation of increased seasonal cooling demand.

Production levels declined modestly at points in the week, and liquified natural gas (LNG) demand, while still light, did increase from the prior week.

As the trading week closed, Dominion Energy Cove Point was up 11.0 cents to $1.560. Columbia Gas was ahead 10.5 cents to $1.415, while Algonquin Citygate was up 13.5 cents to $1.620.

But Bespoke said prices are highly dependent on strengthening heat waves, given stubborn challenges elsewhere.

Markets started to absorb new concerns that a return of associated gas production is likely as oil drillers resume activity, in addition to signs of new weakness in LNG.

NatGasWeather noted that the latest Baker Hughes Co. rigs report, released Friday, showed a decline of just one oil rig. “This suggests declines in associated natural gas production have reached a peak.”

On Wednesday, the firm added, the U.S. Energy Information Administration’s (EIA) weekly oil report showed an increase in oil production week over week.

While up from a week earlier, LNG flows remained subdued relative to pre-pandemic levels, the result of reduced economic activity and, by extension, waning demand for U.S. natural gas exports as the virus continues to spread.

“There remain strongly negative aspects, highlighted by LNG exports remaining very weak and only around 4 Bcf/day, compounded by hefty cargo cancellations already announced for July and August,” NatGasWeather said, referring to news reports of dozens of cancellations. “There’s certainly nothing bullish about supplies being already over 3 Tcf before the start of July.”

Scott Brown, Raymond James & Associates’ chief economist, noted that the International Monetary Fund (IMF) revised its forecast of global economic contraction in 2020 to negative 4.7% from minus 3.0% in March. The IMF blamed the pandemic.

U.S. tallies of the virus surged over the week, twice recording daily records as cases spiked in heavily populated states. The World Health Organizations said the disease is spreading in June at an accelerated pace globally, as well.

“It’s all about the pandemic,” Brown said on Friday. “Rising cases in a number of states fueled fears of a second wave of infections and a more protracted economic recovery.”

Brutal Week

Natural gas futures were under heavy pressure most of the week.

Early in the week, markets weighed the concerns about new associated gas coming on despite still soft LNG demand. July futures lost ground each of the first three days of the week.

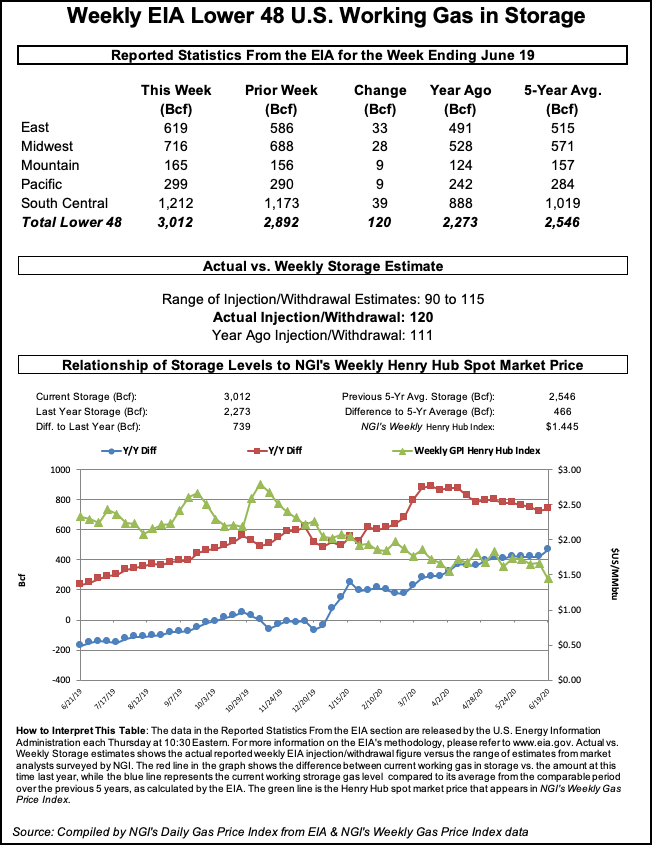

On Thursday, the EIA reported an injection of 120 Bcf natural gas storage for the week ending June 19. It far exceeded expectations and sent futures down 11.5 cents to $1.482 /MMBtu, marking the first time in 25 years that gas prices settled below $1.500.

The build lifted inventories to 3,012 Bcf, well above the five-year average of 2,546 Bcf.

Prior to the report, a Bloomberg poll found injection estimates ranging from 100 Bcf to 114 Bcf, with a median of 108 Bcf, while a Reuters survey produced a 90 Bcf to 115 Bcf injection range and a median of 106 Bcf. NGI estimated a 116 Bcf build.

Bespoke said the supply/demand balance reflected by the latest injection was “disastrous.”

“It’s fair to say that the gas market is feeling its collective stomach drop right about now,” analyst Sheetal Nasta of RBN Energy Inc. said after the storage report.

Markets did take some solace in Friday forecasts for stronger July heat that is expected to drive increased cooling demand.

The July Nymex gas futures contract inched ahead 1.3 cents on Friday and settled at $1.495/MMBtu. The July contract moved off the board at the close of the week’s trading.

But that was far off the week earlier close of $1.669 /MMBtu.

Current price levels point to “bigger problems looming for the gas market,” namely “total demand, including exports, has been exceptionally weak,” Nasta said.

“As a result,” she added, “by mid-July, the storage inventory appears likely to reach record highs for that time of year — record highs that may well persist through the end of injection season in early November unless there is a substantial correction in the gas supply/demand balance. Moreover, it’s looking less and less likely that relief will come from the demand side.”

Cash Crumbles Late

Spot prices retrenched Friday even as forecasts called for more heat.

NatGasWeather sees intensifying overall heat trends moving into the first full week of July, with widespread highs of upper 80s and 90s, along with 100s in swaths of the southern and western United States.

“We view the pattern as hot enough to be considered bullish since it will result in above-normal cooling degree days,” the firm said. “However, oversupplied conditions continue to weigh on prices.”

El Paso Permian lost 14.0 cents day/day to average to $1.205, while PNGTS dropped 16.0 cents to $1.715.

SoCal Citygate slid 19.5 cents to $1.540, and Kern Delivery shed 21.0 cents to $1.455.

ANR SE was among only a handful of exceptions to the rule, rising 4.0 cents to $1.400.

On the pipeline front, Southern California Gas (SoCalGas) said it would begin maintenance work Monday that is to disrupt 130 MMcf/d of imports in addition to the 155 MMcf/d already impacted from L235-2 work. Genscape Inc. said the new project “will require zero flow at the Needles points, which have brought in an average of 131 MMcf/d in the last month.” The work is scheduled to culminate on July 17.

“SoCalGas should mostly be able to accommodate for this newest reduction by increasing its receipts from the Topock points,” Genscape said. “There is even ample available capacity for gas to continue flowing to SoCalGas from Transwestern, via the Topock interconnect instead of the Needles interconnect.”

Additionally, Cheyenne Connector Pipeline launched operations Friday. A total of 162 MMcf/d of receipts were nominated as of evening cycle data, Genscape said, with all of it flowing northbound to an interstate interconnect with Rockies Express Pipeline.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |