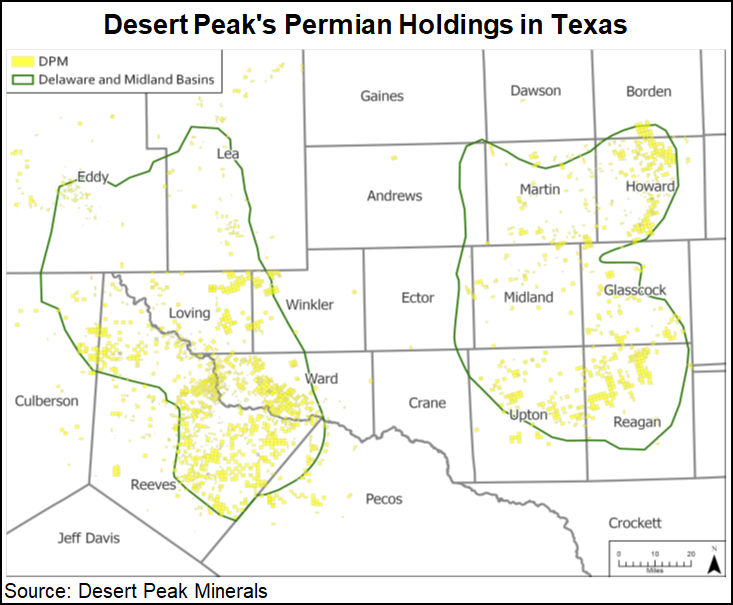

Lower 48 minerals and royalty rights producers Desert Peak Minerals and Falcon Minerals Corp. have agreed to combine in an all-stock transaction with holdings concentrated in the Permian Basin and targets in the Austin Chalk, Eagle Ford and Marcellus shales.

The merger, with an enterprise value of $1.9 billion, estimates combined production by mid-year would be 13,500-14,500 boe/d, with most activity (73%) in the Permian.

“We believe the ownership of Permian minerals and royalties is trending toward larger-scale, more efficient institutional ownership,” Desert Peak CEO Chris Conoscenti said. “Our strategy is to be the leading consolidator of these high quality Permian assets. We believe our scale is a clear strategic advantage in the minerals business as we are able to...