E&P | NGI All News Access | NGI The Weekly Gas Market Report

Denbury Launches $400M EOR Project in Cedar Creek Anticline

Denbury Resources Inc. is moving forward with a $400 million enhanced oil recovery (EOR) project in the Cedar Creek Anticline (CCA) covering parts of Montana and the Dakotas, expecting to ultimately produce more than 400 million bbl.

Initial tertiary production is expected to begin as soon as late 2021.

“The decision to sanction this significant project marks a major milestone for the company and highlights our confidence in the significant long-term oil production and cash flow potential of this key asset,” said CEO Chris Kendall. “We expect this project could ultimately produce more than 400 million bbl through CO2 EOR, much greater than Denbury’s entire current proved reserves base.”

The Plano, TX-based producer, whose area of expertise is conducting EOR through carbon dioxide (CO2) recovery methods, said the first two phases of the project could generate an estimated $3 billion of cumulative net free cash flow, assuming a crude oil price of $60/bbl. Denbury added that it could fund the estimated $250 million price tag to achieve initial tertiary production, which would include a CO2 pipeline, within existing cash flow.

Kendall said the project would still be attractive if oil prices were at $50/bbl. Denbury’s position in the CCA covers about 175,000 acres and is estimated to hold up to 5 billion bbl of original oil in place. The company also owns large reserves of CO2.

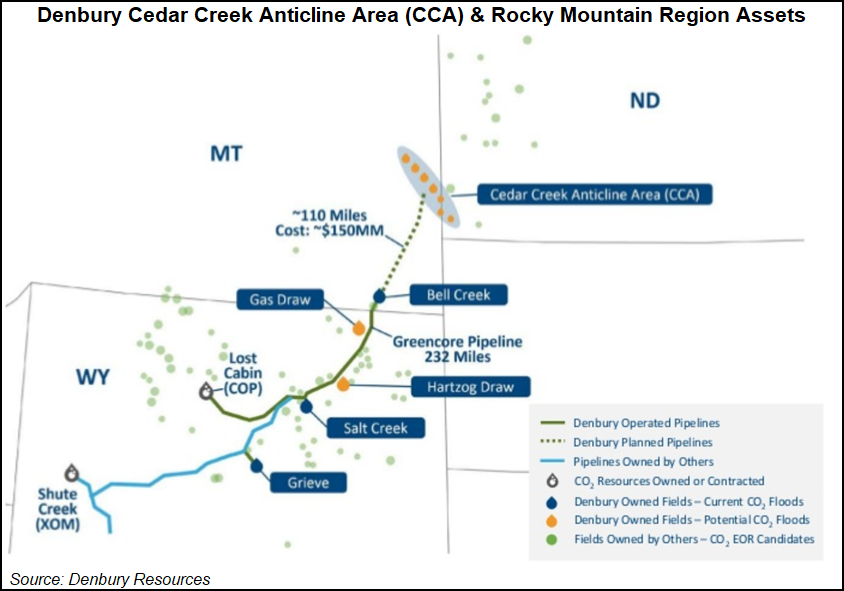

The first phase of the project would target 30 million bbl of estimated recoverable oil in the Red River formation, at the East Lookout Butte and Cedar Hills South oilfields. Denbury plans to build a 110-mile, $150 million extension of its Greencore Pipeline, a 20-inch diameter pipeline that transports up to 725 MMcf/d of CO2 from facilities near Lost Cabin, WY, to the Bell Creek Field in southeast Montana. Greencore was initially built in two segments, the second of which was completed in late 2012.

Denbury estimated it would spend $400 million in total capital for the project over the next 15 years. The company is estimating it will spend $100 million on field development capital before first tertiary production in addition to the cost for the Greencore extension. It also estimates that capital investment would peak at $125-150 million in 2019 to cover the pipeline costs, but it would spend less than $50 million annually on the project after that.

The producer expects to use existing cash flow to fund the field development and pipeline extension costs, but it would evaluate external capital sources to help fund the latter.

First tertiary production is projected to begin in late 2021 or early 2022, with incremental production expected to reach 7,500-12,500 b/d within three years of first production. Payout from the first phase of the project is expected within two years of first production.

The second phase of the project, expected to begin in 2022, would target about 100 million bbl of recoverable oil in the Interlake, Red River and Stony Mountain formations, all of which are within the Cabin Creek oilfield. Denbury estimated that it would cost $500-600 million “over multiple decades” to fund the project’s second phase, but expects it to be “fully funded” through cash flow from both phases of the project.

Additional phases targeting more than 300 million bbl of recoverable oil in the Interlake, Red River and Stony Mountain formations “in Denbury’s other CCA fields will be developed based on CO2 availability and other factors,” the company said.

Denbury acquired nearly 86,000 net acres in the CCA in early 2013 from a ConocoPhillips subsidiary for $1.05 billion. The leasehold is in southwestern North Dakota and eastern Montana, near areas where Denbury was already operating.

Last year, Denbury acquired Linn Energy Inc.’s interest in Wyoming’s Salt Creek Field for $71.5 million. At the time, Denbury was also partnering with Australia’s Elk Petroleum Ltd. to develop the Grieve CO2 EOR project in Wyoming.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |