LNG | LNG Insight | Markets | NGI The Weekly Gas Market Report

Demand Slowdown Outpacing Natural Gas Production Decline, Keeping Lid on Prices, Says EIA

Continuing economic sluggishness brought on by Covid-19 mitigation efforts is weighing down demand for natural gas, but there could be a price uptick on the horizon, according to the U.S. Energy Information Administration (EIA).

Henry Hub spot prices are expected to average $2.46/MMBtu in 4Q2020, bringing the 2020 average to $1.93/MMBtu, EIA said in its latest Short-Term Energy Outlook (STEO), which was released Tuesday. That full year forecast is down 11 cents from the agency’s previous STEO. EIA also said it expects the Henry Hub price will average $3.10/MMBtu in 2021 — two cents higher than forecast in the previous STEO — as falling production levels continue to exert upward price pressures.

“Henry Hub spot prices averaged $1.63/MMBtu in June, down 12 cents/MMBtu from May and the lowest inflation adjusted monthly average price since at least 1989,” EIA said.

“Currently, the effects of reduced natural gas demand are outweighing the effects of falling U.S. natural gas production and are contributing to low natural gas prices. EIA expects that these conditions will largely persist in the coming months, keeping the third quarter average price at $1.65/MMBtu. However, EIA expects general upward price pressures to emerge later in 2020 as demand for natural gas increases and production continues to decline, particularly in the fourth quarter when space heating demand rises.”

The front-month natural gas futures contract for delivery at the Henry Hub settled at $1.67MMBtu on July 1, down 10 cents from June 1. On June 26, EIA said, the price of the front-month futures contract fell to its lowest real price in the history of the contract.

“The drop in prices during the month was likely a result of above-average storage injections that further increased natural gas stock levels relative to the five-year average,” EIA said. “U.S. natural gas production decreased from 91.2 Bcf/d in June 2019 and 89.2 Bcf/d in May 2020 to 88.1 Bcf/d in June 2020. Meanwhile, U.S. consumption was 70.4 Bcf/d, essentially unchanged from 70.5 Bcf/day in June 2019 but nearly 3 Bcf/d more than in May 2020.”

On Thursday EIA reported a 65 Bcf injection for the week ending June 26, bringing working gas inventories to 3,077 Bcf, 30% more than the year-ago level and 18% more than the five-year average level.

“Weekly storage injections so far during the April-October injection season have been close to the five-year average rate as falling production has been offset by falling demand from the industrial sector and LNG exports,” EIA said.

The agency expects declining production will cause injections to fall short of the five-year average later in the summer. But because of the high starting point for inventories during the injection season, EIA is forecasting inventories will reach a record 4,039 Bcf by the end of October, which would be 8% more than the five-year average for that time period.

Estimated dry natural gas production was 89.9 Bcf/d in 2Q2020, a 6.3% (6.1 Bcf/d) decrease compared with 4Q2019. The production decline is the result of a sharp drop in drilling activity prompted by low gas and crude oil prices due to production curtailments, EIA said, and is likely through the end of the year, with 2020 production averaging an estimated 89.2 Bcf/d, down 3.0 Bcf/d (3.2%) from 2019. In 2021, EIA expects dry natural gas production to decline a further 5.0 Bcf/d (5.6%) from 2020, with the low point coming in 2Q2021

EIA forecasts the low point in natural gas production to occur in the second quarter of 2021 at an average of 83.3 Bcf/d, which would be down 12.7 Bcf/d (13.2%) from the 4Q2019 peak. “However, toward the second half of 2021, as Henry Hub prices rise and economic conditions become more favorable, EIA expects dry natural gas production to increase, reaching 85.6 Bcf/d in the fourth quarter of 2021,” according to the STEO.

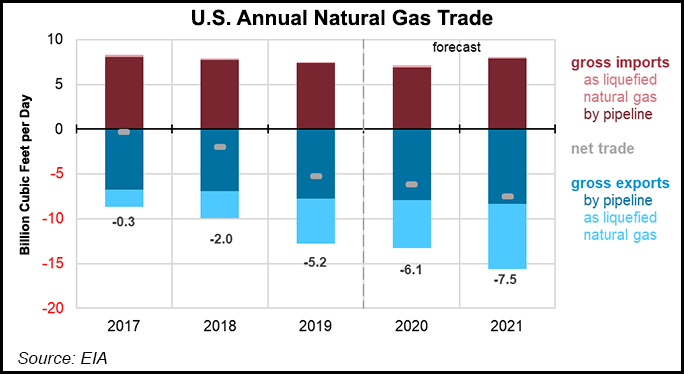

EIA expects net natural gas exports will rise to average 6.1 Bcf/d in 2020 and 7.5 Bcf/d in 2021. Net exports of U.S. liquefied natural gas (LNG), which averaged an estimated 5.0 Bcf/d in 2019, are expected to increase to 5.4 Bcf/d this year and 7.3 Bcf/d next year.

“U.S. LNG exports averaged 7.7 Bcf/d through the first four months of 2020, but declined by 17% between April and May,” EIA said. “A mild winter and Covid-19 mitigation efforts have led to declining global natural gas demand and high natural gas inventories in Europe and Asia, reducing the need for LNG imports. Historically low natural gas and LNG spot prices in Europe and Asia have reduced the economic viability of U.S. LNG exports, which are highly price sensitive.

“In the summer 2020, more than 70 LNG export cargoes from the United States were canceled for June and July deliveries, and more than 40 cargoes were canceled for August deliveries. In comparison, 74 cargoes were exported from the United States in January 2020.”

As a result of those cancellations, U.S. LNG exports averaged an estimated 3.6 Bcf/d in June, and EIA forecasts that they will average 2.2 Bcf/d in July and August, implying a 25% utilization of LNG export capacity. EIA expects LNG exports to increase beginning in September and average 7.1 Bcf/d from December through February as global natural gas demand gradually recovers.

Pipeline exports to Mexico averaged 5.3 Bcf/d in1Q2020, an increase of 9% compared with the same period in 2019, EIA said. Exports to Mexico are expected to continue to increase as more gas-fired power plants come online in Mexico and more pipeline infrastructure within Mexico is built. EIA expects gross U.S. pipeline exports to Mexico and Canada to average 7.9 Bcf/d and 8.3 Bcf/d in 2020 and 2021, respectively.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 1532-1266 |