December Natural Gas Futures Drop After Bearish Storage Injection Punctuates Weather Worries

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |

Natural Gas Prices

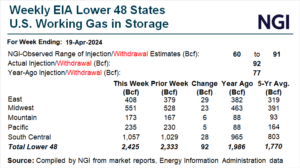

The latest natural gas storage report by the U.S. Energy Information Administration (EIA) surprised the market with a bigger-than-expected 92 Bcf injection for the week ended April 19. Natural gas futures initially responded by trading lower before narrowing their day/day decline. The May Nymex contract was trading 3.6 cents lower day/day at around $1.617/MMBtu in…

April 25, 2024Energy Transition

By submitting my information, I agree to the Privacy Policy, Terms of Service and to receive offers and promotions from NGI.