Death of New Rig Orders ‘Greatly Exaggerated,’ Says NOV Chief

National Oilwell Varco Inc. (NOV), one of the leading high technology manufacturers for the upstream, is seeing some “green shoots” of growth in North America’s onshore, in part because drilling equipment is wearing out, and because customers are demanding the best components available, CEO Pete Miller said Friday.

“The operators want the best rigs,” Miller told analysts during a quarterly conference call. “They want the most highly technical rigs…That’s why I think that the rumor of the death of the order of new rigs has been greatly exaggerated. I’m very confident that things are going to continue on in a very positive fashion…”

The CEO said the story “is really about technology. Technology marches on. And as technology improves, that changes rigs.”

He noted Helmerich & Payne’s (H&P) announcement Thursday that it has secured nine new contracts with four explorers for newbuild rigs within the United States. Since the start of October, H&P has obtained newbuild commitments for fiscal 2014 for 22 of its proprietary FlexRigs, bringing the total to 35 (see Shale Daily, June 24, 2013).

“Well, why would that happen if in fact there are rigs still stacked up that people could pick up?,” Miller asked. “I’ll tell you why that could happen. It’s a proxy for what’s going on inside the industry.”

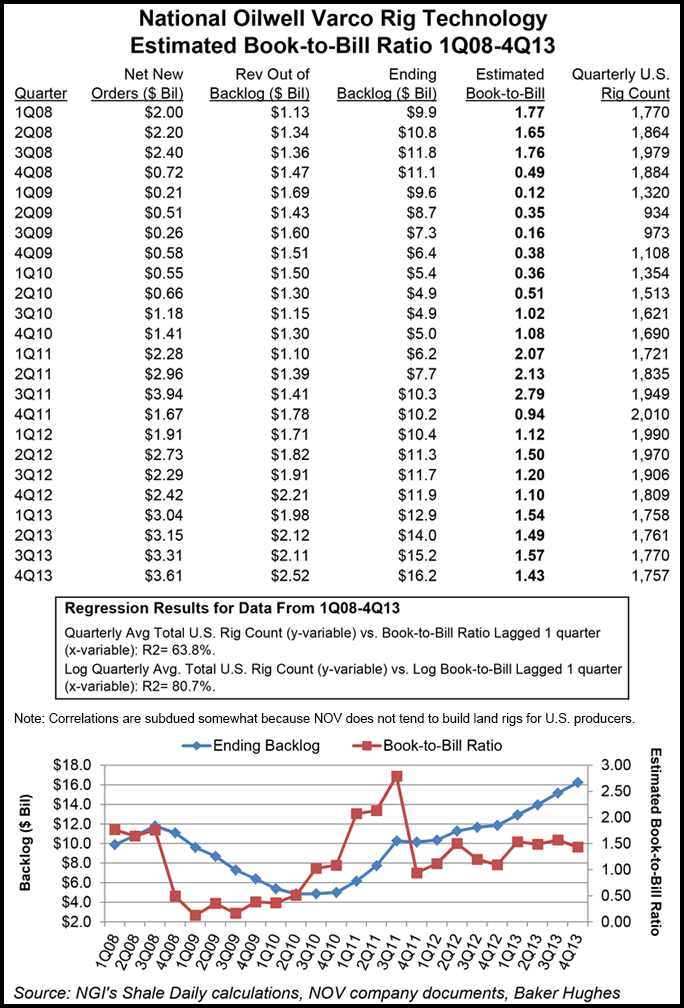

NOV designs and sells high-tech equipment and components that are used in oil and natural gas drilling; it also provides integration services to the upstream. Its capital equipment backlog within the global rig technology segment hit a record $16.7 billion in 4Q2013, 7% higher sequentially and 37% more than in the year-ago period. New orders in the latest quarter, both for onshore and offshore operators, came in at $3.61 billion.

NOV’s 4Q2013 book-to-bill ratio was 1.43, down slightly from 3Q2013’s 1.457 and from 1.49 in 2Q2013 (see Shale Daily, Oct. 25, 2013).

The book-to-bill ratio represents the amount of additions to the backlog, divided by the amount of revenue that was booked from backlog in that same period. The ratio doesn’t explain 100% of the backlog changes from period to period, because it doesn’t incorporate, among other things, turns business (orders taken and filled in the same period), cancellations and order push-outs. Book-to-bill ratios above 1.00 generally indicate that backlog grew during the measurement period.

Anecdotal information from competitors and customers point to “encouraging” signs in the onshore, NOV COO Clay Williams told analysts.

“We see some green shoots in North America, specifically in interventions, hydraulic fracturing stimulation equipment.” Some “opportunistic sales” of fracturing equipment during the final part of 2013 was met through inventory, Williams said.

In addition, customers of late have been calling looking for replacement parts and pumps. So we’re seeing here and there indications that perhaps some folks are starting to work through their inventories of consumables…

“There’s cycling going on in the fleet, which is to be expected, in that operators are wearing out fracturing and coil tubing units and parking those and picking up the idled units,” said Williams. “That’s expected given the high pace of mobilization and how hard this equipment is working.”

The turnover in equipment is “the engine that’s going to drive future demand,” said the COO. “Past cycles have taught us that you run this equipment really, really hard, and then once utilization hits a certain level, then [operators have] got to come back to us and our competitors to restock those consumables and buy new units.”

However, NOV hasn’t seen a “clear hunger as to whether 2014 is the year we come back with a vengeance, but we are seeing a few anecdotal signs of encouragement out there across the board in North America.”

The Houston operator earned $658 million ($1.53/share) in 4Q2013, up 3% sequentially but down 2% year/year. Revenues in the final period rose 9% sequentially to $6.17 billion on operating profits of $973 million, or 15.8% of sales, which was 14% higher than in the third quarter. Quarterly results included a record $1.5 billion in cash flow from operations, 50% higher than the previous record set in 3Q2013.

For 2013, NOV earned $2.33 billion net ($5.44/share), on operating profits of $$3.41 billion. Revenues totaled $22.77 billion. Operating profits were $3.41 billion.

“As we enter 2014, we recognize that there remain headwinds facing us in the North American land market,” said Miller. “However, we are excited to be entering the year with strong financial resources, a very solid backlog and an experienced group of employees at NOV that remains committed to delivering the highest quality of products and services to our customers.”

Spinning off the distribution business at the end of March, which Miller will head, “will enable the distribution business and the remainder of NOV to have the enhanced operational flexibility to focus on their specific products, services and customers.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |