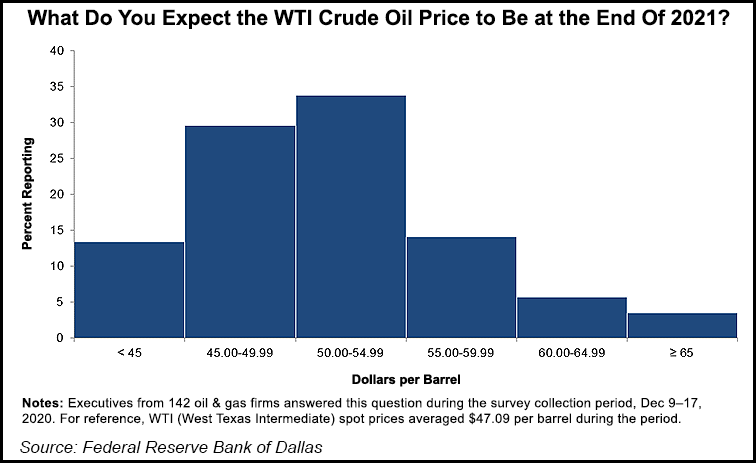

U.S. energy executives remain wary about the outlook for the oil and natural gas markets this year, and are relying on moderate commodity prices as they finesse their 2021 capital spending plans, according to a recent survey by the Federal Reserve Bank of Dallas.

The Dallas Fed, as it is better known, every quarter surveys executives of exploration and production (E&P) firms and oilfield services (OFS) companies headquartered in the Eleventh District. The district encompasses northern Louisiana, most of New Mexico and Texas, home to the Permian Basin, Eagle Ford and Haynesville shales.

Data were collected Dec. 9–17, and 146 firms responded, including 97 E&Ps and 49 OFS operators.

“The latest survey results show some signs of improvement in the oil and gas sector,” said...