Shale Daily | E&P | Eagle Ford Shale | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

‘Cutthroat’ Times in Oil/Gas Patch as Rig Count Decline Slows

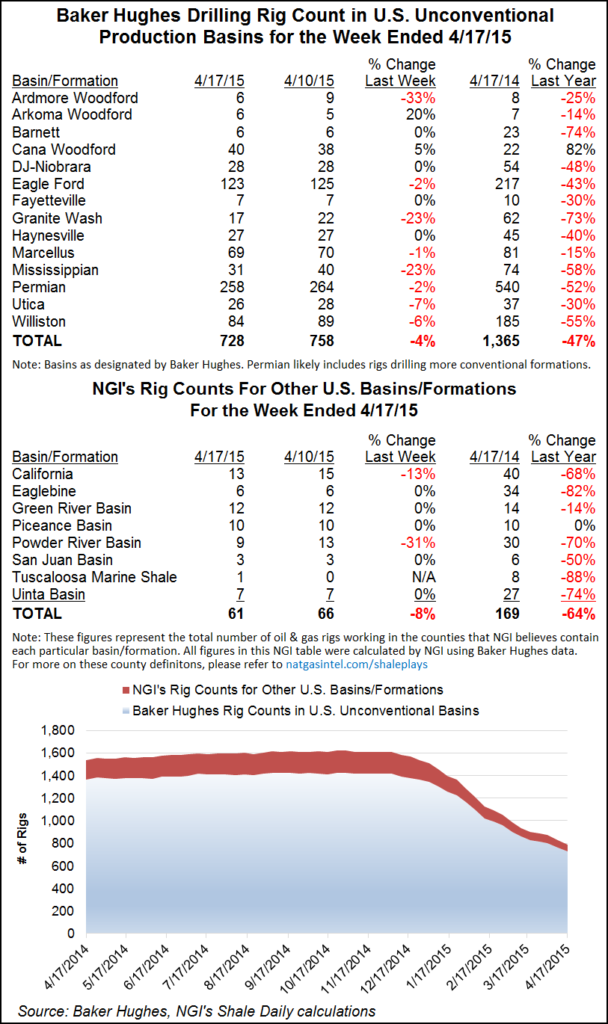

The pace of decline in the U.S. rig count has been slowing, and the latest figures from the Baker Hughes Inc. rig count support this. There has been plenty of pain in the U.S. onshore, and there’s more to come, according to analysts at Raymond James & Associates Inc.

In the United States, the oil-directed rig count for the week ending May 15 fell by 8 in the latest count to 660, while the gas rig census added two to rest at 223. The Eagle Ford Shale added three rigs, and the Permian Basin lost four, continuing a trend of more modest declines seen in the previous week’s count (see Shale Daily,May 8).

“Given the rapid declines in rig counts and overall activity levels, it isn’t surprising that oil service operators were in lower spirits than last year” at the Offshore Technology Conference in Houston earlier this month, Raymond James said in a note on industry sentiment at the major conference. Onshore “…operators appear to be employing different strategies with many hesitant to accept newer or higher-cost options.”

Some companies are taking advantage of the activity slowdown to experiment with new technologies, Raymond James said, but others are more focused on costs and sticking with what they know works. And competition is “cutthroat,” the analysts said.

“Companies are either slashing prices to gain market share or maintaining sufficient margins to remain cash flow positive.”

The Eagle Ford is seen as the most competitive play due to the availability of so much completions equipment and capacity. But over in the Permian Basin there is far less competition “with substantial work keeping service providers busy,” Raymond James said.

“Based on numerous conversations, many operators were optimistic, but still very hesitant, that a bottom would soon be developing in activity within the next couple of months…With continued weakness in activity, small players will continue to face significant pressure, and some will likely not make it through the downturn.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |