Texas-based exploration and production (E&P) firms Independence Energy LLC and Contango Oil & Gas Co. have created Crescent Energy Co. after completing an all-stock transaction.

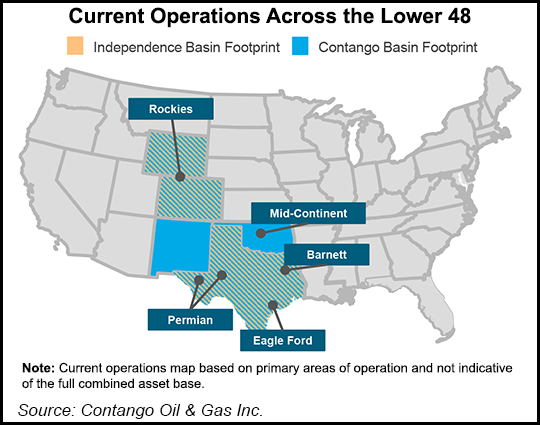

Houston-based Crescent, whose assets are across the Lower 48, had pro forma production of about 119,000 boe/d during 3Q2021. The Independence portfolio spanned the Eagle Ford Shale, Rockies, Permian Basin and Midcontinent, while Contango had assets in the Midcontinent, Permian, Rockies and in the Gulf of Mexico.

“We believe the current market environment provides opportunity to significantly grow Crescent and create meaningful shareholder value by executing our differentiated strategy focused on cash flow, risk management and investment returns,” said Crescent CEO David Rockecharlie.

The company...