Regulatory | NGI All News Access

CRE Renews Natural Gas Quality Exemptions for Southern Mexico

Energy regulators have extended indefinitely a resolution allowing Petroleos Mexicanos (Pemex) to inject off-specification natural gas into pipelines serving southern Mexico.

For at least three years, the Comision Reguladora de Energia (CRE) has repeatedly authorized Pemex to commercialize sub-standard gas in the south because of persistent supply shortages and the increasing nitrogen contamination of associated gas produced at southern offshore fields, the region’s principal source of the molecule.

“The current authorization will remain in force until supply alternatives emerge, or planned modifications to the Norma Oficial Mexicana NOM-001-SECRE-2010 on Natural Gas Specifications take effect, whichever comes first,” the CRE said last week.

The CRE ruling allows Pemex’s downstream subsidiary, Pemex Transformacion Industrial (Pemex TRI), to inject gas with a maximum nitrogen content of 8% and a minimum higher heating value (HHV) of 36.06 megajoules/cubic meter (MJ/m3). The normal quality standards in southern Mexico allow gas with up to 6% nitrogen and a minimum HHV of 36.80 MJ/m3.

Pemex TRI is also required to offer discounts to end users that receive the off-spec gas. The company currently adjusts its prices for three quality zones in the south: Sur-Cardenas, Sur-Minatitlan and Istmo.

In May, Pemex TRI offered its southern clients a discount of 1.14 pesos/gigajoule (GJ) in Sur-Cardenas, 0.12 pesos/GJ in Sur-Minatitlan and 0.17 pesos/GJ in Istmo, according to the latest data from the company. The average adjusted prices in these zones were 68.59 pesos/GJ, 69.61 pesos/GJ and 72.09 pesos/GJ, respectively.

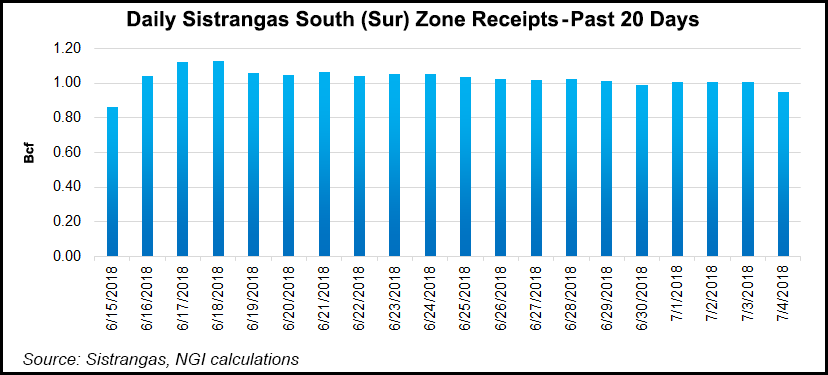

The quality exemptions apply to gas injected into the southern section of the Sistrangas, which is Mexico’s largest gas transmission network, and the privately owned Mayakan pipeline serving five combined-cycle power plants on the Yucatan peninsula.

CRE determined that failing to renew the exemptions would worsen the gas supply deficit currently afflicting southern Mexico, which experiences blackouts during the hotter summer months, according to a resolution approved on June 28.

U.S. gas imports currently do not reach that far south, while the associated gas supply from Pemex’s offshore oilfields in the region has dropped sharply in recent years. Authorities have announced several midstream projects that would help ease gas shortages in the region once new imported supply from the South Texas border comes onstream later this year.

Pemex told CRE this year that it expects associated gas output at its southern onshore and offshore fields to decline substantially over the short to medium term, according to the resolution.

The company mainly produces sour wet gas at its southern oilfields. To offset natural declines in these areas, Pemex has employed artificial lift systems and secondary recovery techniques that have gradually increased nitrogen contamination in the gas stream.

Ethane separation carried out at Pemex’s processing plants, in order to supply a 66,000 b/d contract with a petrochemical plant in Veracruz, also reduces the HHV of the gas available in the region, according to the company.

Budget constraints have delayed projects proposed by Pemex TRI to clean up the nitrogen-contaminated gas. These include plans to rehabilitate a nitrogen rejection unit (NRU) at the Ciudad Pemex processing complex in Veracruz, as well as a separate project to remove nitrogen from gas produced at the company’s offshore assets.

The first train at the Ciudad Pemex NRU has been offline since 2015, but is expected back in service by August this year, according to the CRE resolution. The second train came back online in December and as of May has been operating at a capacity of 220 MMcf/d.

The other project targeting the offshore areas, which includes the construction of nitrogen removal plants and other infrastructure, was approved by Pemex’s board of directors on May 29, according to the resolution. The company expects to complete the project by mid-2021.

Pemex also has several projects to reduce flaring and increase associated gas utilization rates at its oilfields. These include infrastructure investments at the state company’s most productive asset, the Ku-Maloob-Zaap (KMZ) offshore project, that would supply an additional 160 MMcf/d to southern petrochemical plants.

A recent discovery at Pemex’s Ixachi-1 well, the state company’s largest onshore find in the last 15 years, could also provide an additional supply of wet gas for the south. The Ixachi field, announced in November, is estimated to hold an original volume of 1.5 billion boe of mostly wet gas and condensate.

In March, Mexico’s upstream regulator approved Pemex’s evaluation plan for Ixachi, which entails the drilling of up to two delineation wells.

Located in Veracruz, the field has an estimated reserve size of 75 million bbl of condensate and 750 Bcf of gas, according to an IHS Markit report in December.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |