CRE Begins Overhaul of Mexico’s LDC Regulations

The Mexican energy regulator plans to create a single natural gas distribution zone spanning the national territory, one of several upcoming changes to how local distribution companies (LDC) operate in the country.

The Comision Reguladora de Energia (CRE) released a draft proposal at the end of October to create a “unified zone” for gas distribution throughout Mexico, replacing the current segmented geographic concession system.

The draft rules are expected to streamline the approval process for LDC operating permits, remove barriers to expand distribution networks and reflect changes introduced in the country’s energy reform overhaul.

The draft is also the first of three pieces of regulation that would significantly change how LDCs do business in Mexico, according to CRE’s Meney de la Peza, head of the natural gas unit.

“This is the first step,” de la Peza told NGI. “The second step would be open access rules for the distribution service…and the third is a new methodology for approving distribution tariffs.”

Creating a unified distribution zone would phase out the remaining vestiges of a concession system dating back to Mexico’s partial energy reforms of 1995. At the time, the government opened up the pipeline, distribution and storage segments of the local gas sector to private participation.

As part of these earlier reforms, the CRE — itself created in 1993 — was granted the authority to create and auction geographic concessions to private LDCs. The permit holders would build out distribution networks in return for the exclusive rights to operate in the concession area over a set period, usually 12 years.

The latest round of Mexican energy reforms eliminated the exclusivity period, but left other parts of the concession system in place. As a result, CRE must still go through the motions of designating specific distribution zones, even though they no longer have any meaning under the regulatory regime for new LDC operating permits, according to de la Peza.

“This new proposal would eliminate a procedure that generates a regulatory burden for permit holders and which in some ways creates artificial barriers to expanding these networks,” she said. “Because if a distributor operating a system wants to expand beyond its designated zone, it first has to ask us to modify that zone and then it has to request that the permit itself be modified.”

CRE began working on the broad overhaul of LDC regulations not long after the energy reforms began at the end of 2013. Driving its plan is the recognition that the existing framework has fallen short of expectations.

“The thinking now is that the exclusivity period is no longer an effective way to incentivize construction,” de la Peza said. “The exclusivity concept has been around for a long time in Mexico and it has not led to any significant expansion of our distribution systems.”

The open access rules and more flexible tariff methodology would form the backbone of Mexico’s new LDC market model, which in many ways mirrors CRE’s treatment of the transmission pipeline business.

The regulator is still finalizing the rules, but in essence it plans to separate the sector’s distribution and marketing activities, according to de la Peza. Distributors would offer open, nondiscriminatory access on their pipeline systems to retailers that market gas directly to end users.

A distributor may also market gas to end users on its systems, although it has to create a separate marketing subsidiary for sales to clients with an annual demand exceeding 5,000 gigajoules (4.74 Mcf) under a separate CRE rule that comes into force at the beginning of 2018.

“The marketers will compete amongst themselves, the distributors that operate the networks will recoup their investments regardless via a kind of capacity reservation system, and consumers will end up with a greater range of supply options,” de la Peza said.

“The idea is that distributors will become low-pressure pipeline operators,” she said. “It’s a model that exists in other countries, where transmission and distribution pipelines are distinguished solely by the pressure at which they transport gas.”

The revised gas tariff structure is expected to encourage network expansion as well, but CRE also expects the new methodology to grant LDCs more flexibility to compete with providers of liquefied petroleum gas, the fuel of choice among Mexican households.

CRE is considering a regime modeled on the Chilean gas market, in which distribution tariffs are calculated with regulated profit caps, to replace the cost-based structure currently in place, de la Peza said.

A draft of the open access rules is due out in December, while the draft of the new tariff regime is set to be issued at the beginning of next year, according to de la Peza. Before they are approved, all of the drafts must undergo a public comment period that usually takes up to two months.

The unified distribution zone regulation has already received various comments, mostly from participants in the local natural gas industry. Common themes include concerns about pipeline duplication, the coexistence of distribution and transmission pipeline systems, and the CRE’s technical definition of distribution systems, which it classifies as any pipeline network operating at a pressure of up to 21 kilograms/square centimeter.

In light of these comments, CRE is now revaluating the technical definition. De la Peza expects other concerns to be resolved once the other two regulations are released.

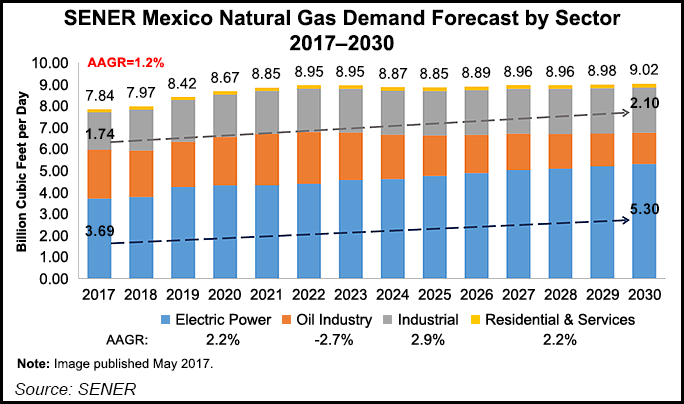

To date, the distribution market makes up a relatively small part of the Mexican natural gas industry. Spain’s Gas Natural Fenosa and France’s Engie SA, among a handful of other firms, have set up shop as LDCs in Monterrey, Mexico City and a few other areas, but residential and small commercial users still account for only a fraction of national gas demand. Instead, gas consumption is mostly driven by the power sector and large industrial users.

“In reality, the most attractive clients for distributors right now are industrial consumers,” de la Peza said. “With the new regulatory model we want to make it attractive for them to go after the residential and small commercial markets…We think it’s more feasible to expand coverage with these clients because, currently, they are quite underserved.”

The Mexican Energy Ministry has also indicated that it would create a public policy to promote residential gas consumption, but it has yet to release a draft of the document.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 |