Oil and natural gas producers in the Midcontinent and Rockies are generally bullish on commodity prices but face challenges including labor scarcity, supply chain issues and drilling cost inflation, according to the latest Tenth District Energy Survey by the Federal Reserve Bank of Kansas City.

The Kansas City Fed, as it is better known, conducts the quarterly survey to gauge upstream activity levels and sentiment around oil and natural gas pricing in the Tenth Federal Reserve District. The district includes all of Kansas, Colorado, Nebraska, Oklahoma and Wyoming, along with the western third of Missouri and the northern half of New Mexico.

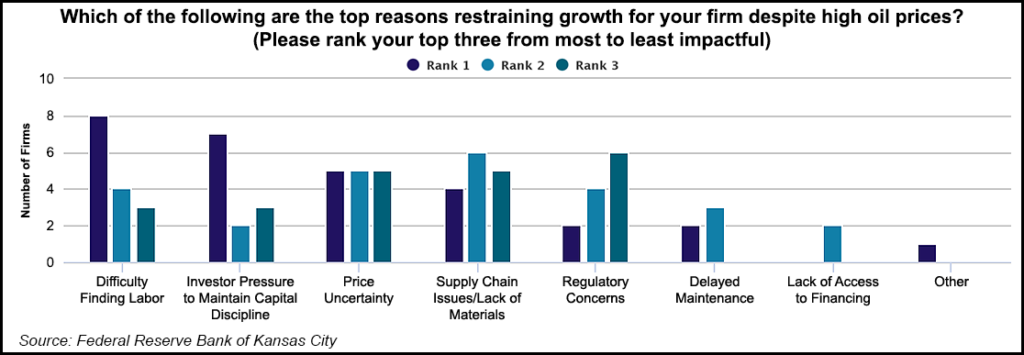

Labor scarcity and investor pressure to maintain capital discipline ranked as the top two factors constraining growth for exploration and...