NGI The Weekly Gas Market Report | Coronavirus | Markets | NGI All News Access

Coronavirus, Oil Price War Worsen Already Shaky Outlook for Mexico’s Pemex

Simultaneous supply and demand shocks currently wreaking havoc on global oil markets have worsened an already precarious outlook for Mexico’s national oil company, Petróleos Mexicanos (Pemex).

The 100% state-owned firm is fresh off a full-year 2019 loss of $18.3 billion, nearly double the loss recorded in 2018.

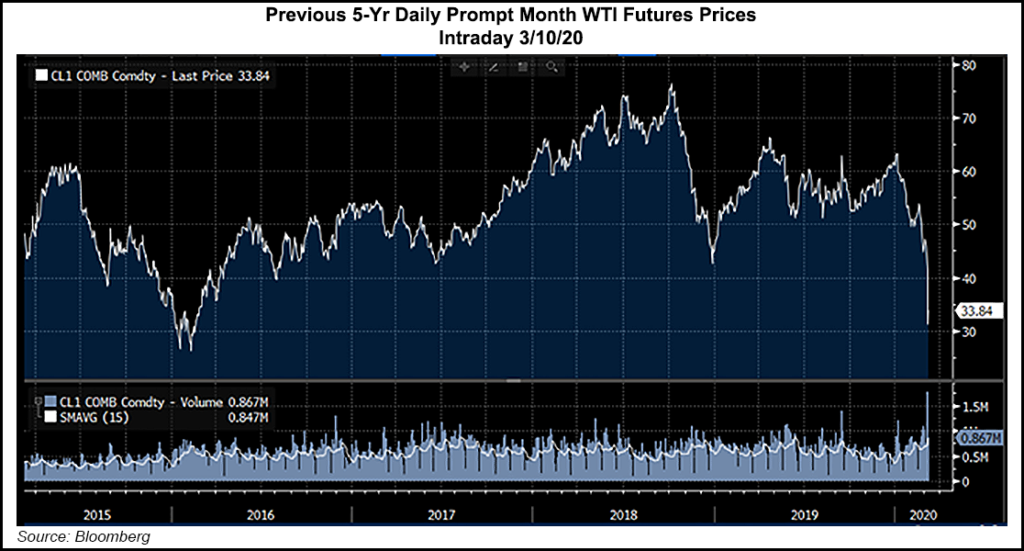

Meanwhile, global crude prices have plunged this week following the breakout of a price war between Organization of the Petroleum Exporting Countries (OPEC) leader Saudi Arabia and its producing ally Russia, compounding an unprecedented nosedive in demand as a result of the coronavirus outbreak.

The price crash has all but erased any hope of profitability at Pemex’s so-called priority onshore and shallow water fields, upon which the company has staked its 2020 capital program, according to local experts.

The majority of these projects will not generate enough cash flow at current prices, Mexico City-based analyst Arturo Carranza told NGI’s Mexico GPI, citing that costs at these fields are higher than at Pemex’s legacy producing fields.

The problem, however, is that President Andrés Manuel López Obrador has pledged to shore up output through accelerating the development of new fields in a bid to “rescue” Pemex and offset the natural decline of its core producing assets such as Cantarell and Ku-Maloob-Zaap.

From a technical point of view, it would make sense for Pemex to scale back investment at the new fields in order to minimize losses in the current price environment, Carranza said, but “this point of view doesn’t enter into the logic of the government…I think that for the current government it’s politically indispensable to develop these priority fields.”

Finance Minister Arturo Herrera seemed to corroborate this view in a televised interview Tuesday, saying that the government not only doesn’t foresee budget cuts this year, it plans to accelerate budgeted spending as a stimulus measure in order to mitigate the worst effects of the coronavirus and the oil price war.

Furthermore, Herrera said the government’s budgeted oil export revenues for this year are “completely covered” by a $1 billion hedging program announced in January, which the ministry said guaranteed an average price of $49/bbl.

Reuters reported in January that in a departure from previous years, an estimated two-thirds of the put options purchased by Mexico in financial markets as part of the 2020 hedging program were indexed to Brent oil prices, as opposed to Mexico’s Maya benchmark.

Mexico’s increasingly heavy and sour crude oil basket closed at $24.43/bbl on Monday, its lowest level since February 2016. Pemex updates the price each day at 6pm local time.

The April 2020 West Texas Intermediate (WTI) futures contract, meanwhile, recovered $3.23 on Tuesday to settle at $34.36/bbl.

“Maya crude is, I think, increasingly vulnerable,” IPD Latin America’s John Padilla, managing director, told NGI’s Mexico GPI, adding that “oversupply…will probably not benefit heavy crude, given the glut that you’re likely to have on the marketplace.”

Following the International Maritime Organization’s (IMO) restrictions on sulfur content in shipping fuel, which went into effect on Jan. 1, Padilla said the spreads between Maya and lighter benchmarks such as Brent and WTI are likely to grow.

The Mexican peso, meanwhile, “has been particularly hit, in large part just because of the heavy debt burden that Pemex carries. So that’s coming back to really hit them pretty hard, and as a result you’ve seen the peso being one of the worst performing currencies…which is in complete contrast to what it was in 2019.”

Padilla said “if there is devaluation of the Mexican peso, and/or if you start to get an increasing spread between Brent and the Mexican basket, that all works against Mexico.”

Although Pemex managed to stabilize declining oil and natural gas production 2019, its export revenues fell 16.5% year/year (y/y), as the average price of the Mexican crude oil basket fell 9.4% to $55.63/bbl.

Padilla expressed the view that, following a downgrade of Pemex debt by Fitch Ratings in 2019, a subsequent downgrade by another rating agency is a near certainty.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 | ISSN © 1532-1266 |