E&P | NGI All News Access | NGI The Weekly Gas Market Report

Continental Profits Surge in 1Q; SCOOP Development Launched

Higher oil prices drove a surge in profits and revenues for Continental Resources Inc. in the first quarter, as the company kicked off an ambitious multi-year oil development program targeting Oklahoma’s myriad stacked reservoirs.

The Oklahoma City-based independent reported net income of $233.9 million (63 cents/share) in 1Q2018, compared with net income of $470,000 ($0) in the year-ago quarter. Revenues were $1.14 billion in 1Q2018, compared with $633.9 million in 1Q2017.

Total production was 25.9 million boe (287,410 boe/d) in 1Q2018, of which 57% was oil (163,837 bbl) and 43% natural gas (741.4 MMcf). Total production increased 34.5% from the year-ago quarter (213,755 boe/d) and 0.15% from 4Q2017 (286,985). Oil production averaged 163,837 b/d, an increase of 37.4% from 1Q2017 (119,201 b/d), but it was down 2.5% from 4Q2017 (168,066).

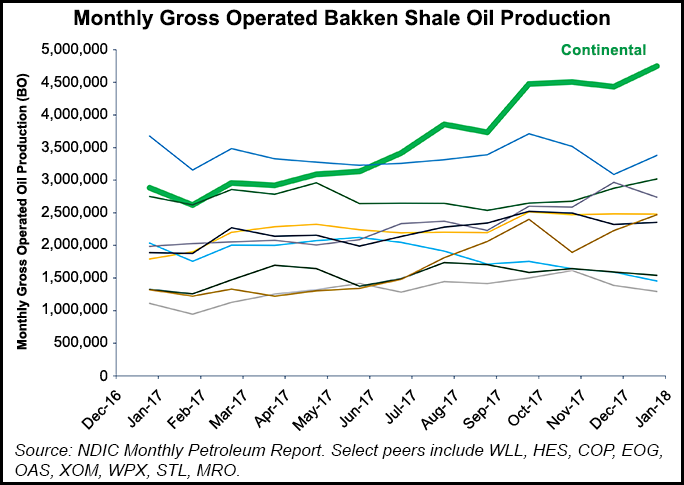

Surging production in two areas where Continental operates — the North Dakota portion of the Bakken Shale and the STACK (aka the Sooner Trend of the Anadarko Basin, mostly in Canadian and Kingfisher counties) — helped offset production declines elsewhere.

In the North Dakota Bakken, production averaged 154,503 boe/d, up 53% from 1Q2017 (101,012 boe/d). STACK production rose 82.6% to 53,361 boe/d, from 29,216 boe/d in the year-ago quarter.

During 1Q2018, Continental completed 31 gross (21 net) wells in the Bakken, 18 gross (14 net) wells in the SCOOP (aka the South Central Oklahoma Oil Province), and 12 gross (seven net) wells in the STACK. The company deployed six rigs in the Bakken in the first quarter, and plans to maintain that level through the rest of the year. In the SCOOP, Continental had eight operated rigs deployed, five targeting the Springer formation, one targeting the Woodford Shale and two targeting the Sycamore formation.

Project SpringBoard

In an effort to accelerate development of its oil and liquids-rich assets, Continental said it would move three of the five rigs deployed in the natural gas window of the STACK, on the grounds that the acreage, which is part of its joint development agreement (JDA) with SK E&S, is “now essentially held-by-production.” Two rigs are to be moved to the over-pressured oil window of the STACK, while one rig will be set up in the over-pressured condensate window of the SCOOP.

SK E&S, a subsidiary of South Korea’s SK Group, formed the JDA with Continental in 2014 to focus on natural gas targets in the northwest portion of the Cana-Woodford Shale.

Continental also launched Project SpringBoard in the Springer Shale portion of the SCOOP, covering 70 square-miles and about 45,000 gross (31,000 net) contiguous acres. The company expects to eventually drill about 100 wells targeting the Springer and up to 250 wells into the Woodford and/or Sycamore. The project is estimated to have a gross unrisked reserve potential of more than 400 million boe.

The first phase of the project is to focus on the Springer, with a second phase focusing on the Woodford and Sycamore. Three rigs have already begun working as part of the project’s first phase. Continental plans to ramp up Project SpringBoard by adding two additional rigs by mid-year.

During an earnings call Thursday to discuss 1Q2018, President Jack Stark said the Sycamore and Woodford were “very oil-rich,” and the company expects to see 60-80% of production weighted toward oil.

“Keep in mind this is the area where we’re actually going to be able to reduce our costs for doing a Woodford well by $1 million,” Stark said. “Our teams came in and have laid out just a beautiful picture of what it takes to do that and how we accomplish this. It’s been tested and we’re ready to implement that type of drilling design going forward…

“We’re going to be able to really drive the cost down and increase the efficiencies like never before from a drilling and completion standpoint. On top of that, the infrastructure that we’re going to be putting in there — for gathering and distributing water — is going to be there and be able to be used as we move into development of the Woodford and Sycamore.”

Stark also disclosed that Continental has “another project of pretty much similar size and scale and working interest that would be up after this. It is in the SCOOP.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |