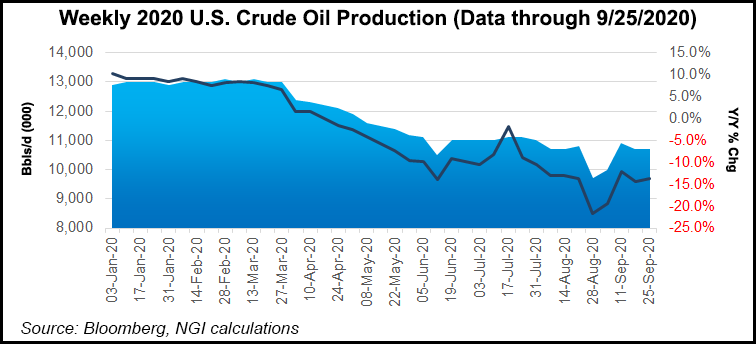

ConocoPhillips expects to see its third quarter 2020 production suffer another double-digit blow and realized prices take a roughly $15 hit as the Houston-based independent curtailed volumes to combat the weak oil environment.

In an operations update issued Wednesday, ConocoPhillips said it expects to report a roughly 262,000 boe/d year/year decline (19.7%) in third quarter 2020 production volumes. Curtailments for the quarter were around 90,000 boe/d, with about 65,000 boe/d taking place in the Lower 48, along with 15,000 boe/d in the Surmont operation in Canada and the remainder in Malaysia and Norway.

In addition to curtailments, the decline also resulted from seasonal turnaround activity in Canada, the Asia Pacific region and Alaska.

ConocoPhillips reported a 24% decrease...