Shale Daily | E&P | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

Concho Sharply Raising 2019 Permian Spend to $3.5B

Despite takeaway constraints in the Permian Basin, Concho Resources Inc. unveiled a capital program of $3.5 billion at the midpoint for 2019, up from $2.55 billion this year, with most of spend devoted to large-scale projects and a 25% exit rate increase in crude oil production.

The Midland, TX-based independent, the first Permian pure-player to announce its 3Q2018 earnings, reported wider losses in net earnings and derivatives compared with the year-ago period.

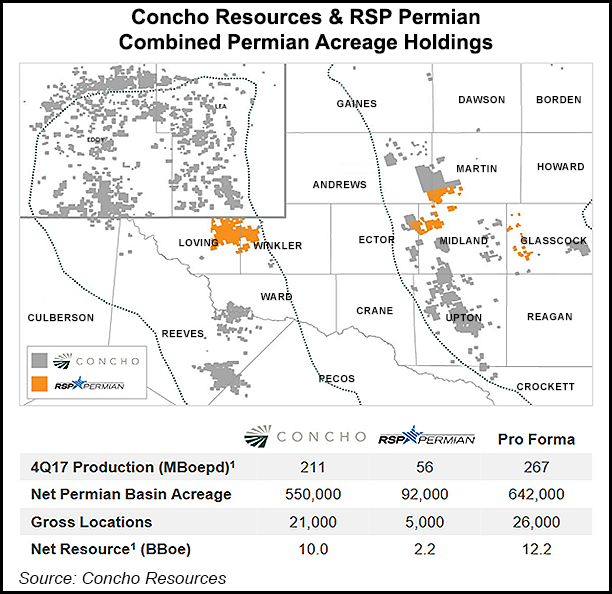

Concho, which completed its $9.5 billion acquisition of RSP Permian Inc. in July, said it plans to run an average of 34 rigs in 2019 and 38 rigs in 2020. Lateral lengths are expected to average 9,700 feet next year, compared to 8,100 feet currently. The company envisions a 25% increase in oil production between 4Q2018 and 4Q2019, as well as an 18% increase in overall output. For the full-year 2019, Concho plans to drill 400-420 wells, complete 350-370 wells and place 390-410 wells into production.

During an earnings call Wednesday, CEO Tim Leach said 2019 activity is based on a West Texas Intermediate (WTI) average oil price of $55-60/bbl.

“We expect more volatility, not less, in oil prices,” Leach said. “We think it’s better for our people, our partners on the service side, and the efficiency of our program to be a steady ship. Planning in this range allows us to prudently step up our capital spend, deliver efficient oil growth, provide shareholders a return of capital and have free cash flow upside.”

Concho would not change its 2019 capital program “based on near-term fluctuations” in WTI prices, even if they ranged from the mid-$60s to the mid-$70s, he told analysts.

“Quite frankly, we are kind of planning for [higher oil prices]. That was the cash flow upside that we see and 2019.”

Moreover, management stressed its planned $3.5 billion spend for 2019 would be within free cash flow, and announced it would initiate a regular quarterly dividend of 12.5 cents/share starting in 1Q2019. Both of these were likely “music to ears of the investment community, as the buy-side has been rewarding producers that exercise spending discipline and return more cash to stakeholders,” noted NGI’s Patrick Rau, director of Strategy & Research.

At one point Wednesday, shares of Concho were up 7.2%. But the stock fell in afternoon trading to end the day at $139.09/share, up 2.5%.

Concho reported an average realized oil price of $56.38/bbl and a hedged price of $53.67 in 3Q2018, which translated to a loss of $625 million on derivatives. That compares with year-ago net losses of $206 million, when the realized oil price was $45.29 and the hedged price was $47.81.

Total production in 3Q2018, excluding results from the RSP acquisition before July, was 26.4 million boe (286,634 boe/d), above the high end of guidance and up 48.4% year/year. At the same time, oil production climbed 54.4% to 17 million bbl (184,554 b/d) in 3Q2018 from 11 million bbl (119,565 b/d) in 3Q2017.

The company averaged 31 rigs and nine completion crews during the third quarter, but it is currently running 34 rigs, including 22 in the Delaware sub-basin and 12 in the Midland sub-basin. Eight completion crews are also currently in the field.

Thirty-one horizontal wells in the Delaware, with an average lateral length of 6,685 feet and an average 30-day peak production rate of 1,422 boe/d (73% oil), were placed into production in 3Q2018. An additional 34 horizontal wells targeting the Midland were also added, with an average laterals of 9,686 feet and peak rates of 1,178 boe/d (86% oil).

Net losses totaled $199 million (minus $1.05/share) in 3Q2018, compared with a net loss of $113 million (minus 77 cents) in the year-ago quarter.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |