Executives at Haynesville Shale-focused Comstock Resources Inc. said they expect 4-5% natural gas-weighted production growth in 2022.

The plan for the year is still focused around capital discipline, with the aim to pay down $479 million in debt so the “leverage ratio is at 1.5 or less. We think we can get there in the second half of 2022, and that does open discussions up on returning capital to shareholders,” CEO M. Jay Allison said Wednesday during a fourth quarter 2021 earnings call.

The company has set production guidance of 1,240-1,290 MMcfe/d for the first quarter and 1,390-1,450 MMcfe/d for 2022.

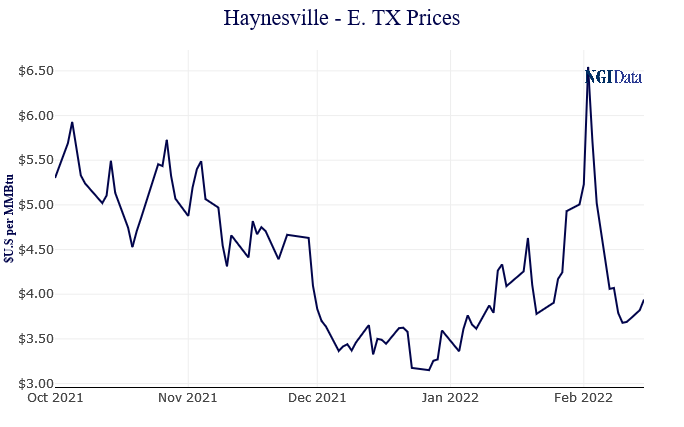

Production increased 12% in 4Q2021 to 1,348 MMcfe/d, 99% weighted to natural gas. The company saw realized natural gas prices of $5.22/Mcf during the quarter, compared to...