E&P | Haynesville Shale | NGI All News Access

Comstock Selling Texas Assets, Drilling in Haynesville

Frisco, TX-based Comstock Resources Inc. said Monday it is selling conventional natural gas properties in South Texas for $28 million, with proceeds to fund drilling this year, while it restarts drilling in the Haynesville Shale.

“This sale strengthens our balance sheet by providing additional liquidity and helps fund our Haynesville shale drilling program,” said CEO Jay Allison.

The sale, to an undisclosed buyer, is expected to close in December and will have an effective date of Aug. 1, 2016. The properties being sold are producing 9.6 MMcf/d of gas and 22 b/d of oil. As of Sept. 30, Comstock’s proved reserves included 57,000 bbl of oil and 48.9 Bcf of gas related to the interests being sold. The company said it expects to realize a pre-tax loss on the divestiture of about $10 million.

The sale follows one by Comstock last year of Texas assets that also resulted in a pretax loss (see Shale Daily, July 2, 2015). Last week, Comstock was noted by Moody’s Investors Service as a recent debt defaulter due to a September distressed exchange (see Shale Daily, Oct. 11).

The company also said it recently restarted its Haynesville drilling program and on Sept. 28 spudded its fourth well this year and plans to add a second operated drilling rig by early November. Plans to focus on the Haynesville were announced at the end of 2014 (see Shale Daily, Dec. 18, 2014).

“Comstock Resources Inc. mentioned in its conference call that the new standard drilling lateral in the Haynesville is 7,500 feet, up from the previous standard of 4,500 feet, with changed completion designs. This gets their rate of returns to 49-79%,” NGI’sPat Rau, director of strategy and research, said recently (see Shale Daily, Aug. 19).

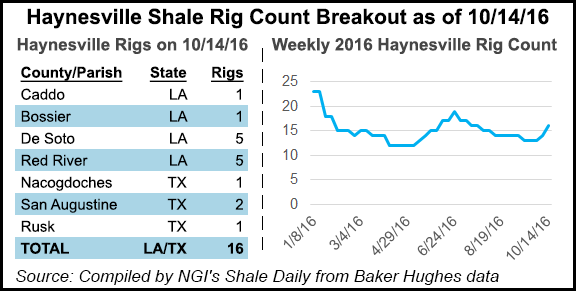

Rigs have been coming back to the Haynesville lately (see Shale Daily, Oct. 14a), and the industry has been watching the play and anticipating increased activity there, in part due to its proximity to petrochemical and liquefied natural gas export demand (see Shale Daily, Oct. 14b).

Hedging for 2017 has also begun with the recent improvement in natural gas prices, Comstock said. The company has hedged 30 MMcf/d of 2017 natural gas production at $3.25/MMBtu.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |