NGI The Weekly Gas Market Report | E&P | Earnings | NGI All News Access

Comstock Hedging Props Up Haynesville Natural Gas Prices; CEO Sees ‘Healthier’ Supply Outlook

Comstock Resources Inc., which works in the Haynesville and Bakken shales, grew natural gas sales year/year and, thanks to hedging gains, better-than-average gas prices.

The Frisco, TX-based company’s chief executive also struck an upbeat tone on the outlook for gas prices, saying pullbacks in oil drilling across the industry will better align supply with demand.

“While natural gas prices are expected to remain low in the near-term as we manage through an oversupplied market resulting from the winter heating season, we anticipate a much healthier supply and demand balance for natural gas later this year and in 2021,” CEO Jay Allison said Thursday in reporting 1Q2020 results.

The outlook “is primarily driven by our expectation for significant declines in natural gas supply…due to a continued reduction in natural gas directed drilling and completion activity and less associated gas production from reduced activity in oil basins” following a collapse in oil prices.

“Our Haynesville drilling program generates economic returns even at today’s low natural gas prices,” Allison said. However, “we have cut back the number of wells we’re drilling in order to generate free cash flow that we will use to pay down our debt and strengthen our balance sheet. That’s a primary focus.”

[Want to see more earnings? See the full list of NGI’s 1Q2020 earnings season coverage.]

Comstock produced 125.5 Bcfe in the first quarter, with 122.8 billion Bcf of natural gas and 454,495 bbl of oil.

Natural gas production averaged 1,349 MMcf/d, an increase of 270% over the year-earlier quarter. The growth was driven by last year’s acquisition of fellow Haynesville operator Covey Park Energy LLC and steady Haynesville drilling, the company said.

Oil production in the first quarter decreased to 4,994 b/d from 9,005 a year earlier, mostly from production declines in the Bakken Shale.

Allison said the natural gas operations in East Texas and North Louisiana were not adversely impacted by the coronavirus pandemic.

“We have modified our procedures and practices to minimize unnecessary risk of exposure and prevent infection among our employees and our contractors,” he said. “Our operations team has continued to execute on our drilling program with little disruption, and production operations have not been impacted.”

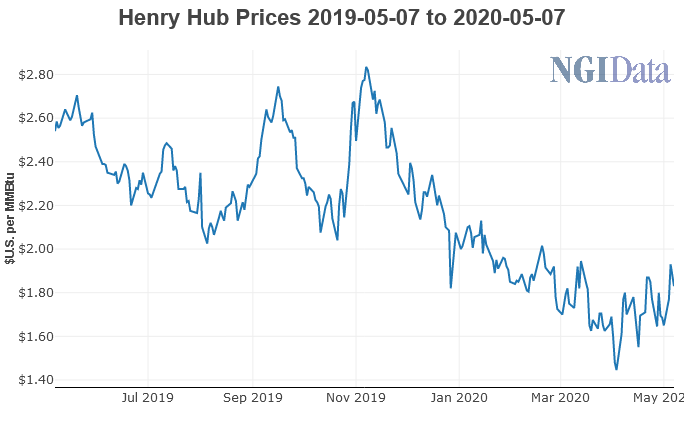

Oil and gas revenue totaled $271 million, 105% higher than the year-earlier quarter. The average realized natural gas price in 1Q2020, including hedging, decreased to $2.04/Mcf from $2.87 a year earlier. However, it comfortably eclipsed the $1.95 Henry Hub average for 1Q2020.

The average realized oil price increased to $46.31/bbl from $45.78 a year earlier, reflecting its active hedging program. The company is now targeting for the next year to have 50-60% of future oil and gas production hedged to protect drilling returns.

While it projected 6-8% production growth in 2020, it is focused on free cash flow generation because of low prices. With a quarter-ending cash position of $16 million, its current liquidity stands at $166 million, Allison said. Debt totals about $2.7 billion, but it has no debt maturities until 2024.

Comstock reported 1Q2020 net income of $30 million (15 cents/share), up from $13.6 million (13 cents) a year earlier.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |