Completion Delays, Dropped Rigs Seen Weighing on Proppant Company Results

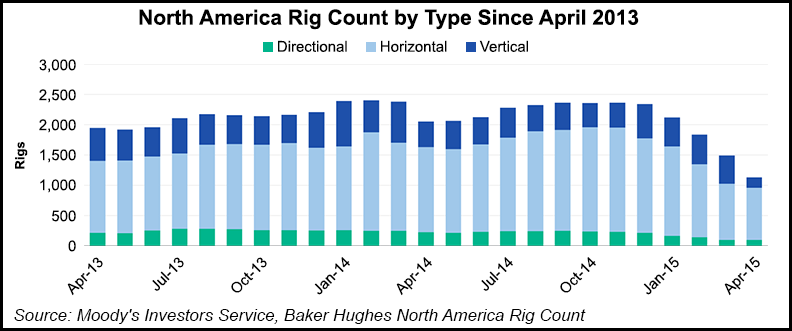

Earnings by the North American oilfield services (OFS) operators and producers are coming in as expected, lower sequentially and from a year ago, foreshadowing weakness for the proppant companies as the onshore rig count continues to decline.

Moody’s Investors Service analysts last week issued an in-depth outlook for the sector, noting that negative outlooks for exploration and production (E&P) companies and OFS companies should bear down on proppant firms. First quarter earnings for the proppant providers is forecast to decline by 10-20% year/year.

“E&P and OFS companies are focused on minimizing operating and capital costs, finding cost efficiencies and maintaining liquidity,” said analysts Karen Nickerson, Felipe Strieder and Glenn B. Eckert. “Proppant companies are responding by collaborating with customers to reduce or eliminate inefficiencies in the supply chain in order to reduce all-in costs at the well sites.

“However, proppant price reductions are also part of this equation. The change in proppant volume for 2015 remains uncertain in light of new sand-intensive drilling techniques, but it is clear volume will decline.”

To date, North American E&Ps have announced capital spending cuts averaging about 40% for this year from 2014, with more cuts expected later this year if oil prices move lower. Land-based drilling rigs have continued to drop, particularly in the higher cost U.S. basins, and many operators are preserving funds by delaying well completions.

“As a result, the number of drilled but uncompleted wells is rising and that is expected to continue until completion services costs come down or oil and natural gas prices improve,” Nickerson and her colleagues wrote. “This translates into even worse demand for proppants than the decline in rig count would suggest.”

Proppant company profit margins and pricing are expected to compress this year. Even though proppant usage per well is increasing, “it won’t be enough to offset rig count decline and the build-up of uncompleted wells.”

Among some of the biggest proppant providers, U.S. Silica Holdings Inc. issues its first quarter results on Wednesday, while Carbo Ceramics Inc. is set to release its results on Thursday. Hi-Crush Partners LP reports on May 6, while Fairmount Santrol’s is scheduled for May 12.

The “logistically advantaged” and geographically diversified proppant producers should be more able to deliver lower cost sand to the well sites, providing an advantage on capturing market share, according to the trio. “However, market share gains will not offset reduced demand resulting from rig count decline.”

Pricing pressures should increase as the year progresses, in line with a decline in demand. In addition, analysts don’t think the proppant companies will challenge their customers to live up to contract terms “but instead advocate in contract negotiations for greater volume or longer terms to counterbalance any price compromise.”

Like the E&Ps and OFS providers, proppant companies have responded to margin pressures by working on efficiencies, lower costs and maintaining liquidity. Besides personnel reductions and other cuts, some operators may have to idle higher-cost facilities while adding capacity at those with lower costs.

In March, Carbo mothballed a proppant manufacturing facility in McIntyre, GA (see Shale Daily, March 10). A month earlier, Carbo said it would defer completing a second proppant manufacturing line at its Millen, GA, facility (see Shale Daily, Feb. 2).

“Proppant companies will endeavor to align inventory with business trends, while still serving customers’ needs,” wrote Nickerson and her team. “Liquidity management will also include flexible capital expenditure plans to accelerate or decelerate investment as market conditions warrant. Proppant companies will focus on ongoing investment in logistics and product solutions for customers. At this time, we expect some of the additional sand capacity that was slated to come online in 2015 will be delayed.”

With many well completions delayed, demand and pricing for hydraulic fracturing/pressure pumping services is seen declining in the first half of this year. Maintaining market share or gaining any bit of share, is going to be vital for the long-term health of some proppant providers, according to Moody’s.

“Some customers are aggressively taking share, some are moving into new basins, while others are losing business, all at a rapid pace. For the proppant producers, these market dynamics required quick and decisive action, and alignment with their customers’ needs. Almost all proppant customers are requesting faster response time,” and the providers need to be able to react.

However, gaining or maintaining share is going to come at a cost.

“To win volume, proppant companies will need to concede on price,” analysts said. “The second half of 2015 should begin to reveal who the winners in proppants will be.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |