Mexico | Infrastructure | Markets | NGI All News Access | Regulatory

COLUMN: Time to Reassess Capacity Allocations on Mexico’s Pipeline System

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |

Markets

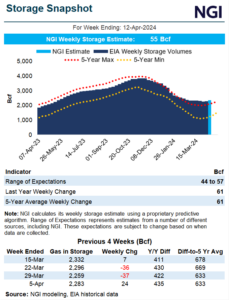

Natural gas futures hovered in positive territory early Thursday as traders assessed a mixed weather outlook against continued lighter production readings while they awaited the latest government inventory data. Following a 2.0-cent loss Wednesday, the May Nymex contract was up 5.0 cents to $1.762/MMBtu at around 8:40 a.m. ET. The federal storage report is slated…

April 18, 2024Markets

By submitting my information, I agree to the Privacy Policy, Terms of Service and to receive offers and promotions from NGI.