Regulatory | NGI All News Access | NGI The Weekly Gas Market Report

Column: The Dangers of a Watered Down CRE in Mexico’s Natural Gas Sector

Editor’s Note: NGI’s Mexico Gas Price Index, a leader tracking Mexico natural gas market reform, is offering the following column as part of a regular series on understanding this process, written by Eduardo Prud’homme. This is the ninth in the series.

Prud’homme was central to the development of Cenagas, the nation’s natural gas pipeline operator, an entity formed in 2015 as part of the energy reform process. He began his career at national oil company Petróleos Mexicanos (Pemex), worked for 14 years at the Energy Regulatory Commission (CRE), rising to be chief economist, and from July 2015 through February served as the ISO Chief Officer for Cenagas, where he oversaw the technical, commercial and economic management of the nascent Natural Gas Integrated System (Sistrangas).

The opinions and positions expressed by Prud’homme do not necessarily reflect the views of NGI’s Mexico Gas Price Index.

In previous columns, I’ve mentioned that the energy reform in 2013-14 wasn’t the first reform in Mexico’s natural gas sector. In 1995, constitutional and legal changes allowed for private sector participation in the transport and distribution of natural gas by pipeline. In conjunction, the energy regulator Comisión Reguladora de Energía, or CRE, was created.

The government of Mexico tasked CRE with regulating the price of Pemex gas. It would also regulate the way in which the state company operated the national pipeline system.

Regulating the natural gas industry in Mexico is complex. It can mean going against the direct interests of perhaps the nation’s most important company, Pemex. Restricting tariffs, using Henry Hub as a pricing reference, and opening pipeline networks to third parties can hurt the financial results of the oil company. Seen through the eyes of some, regulation might also seem schizophrenic, as limiting Pemex’s monopoly rent can impact public finances.

As a result, CRE has traditionally been viewed with some distrust by bureaucrats. A regulatory body focused on allowing the participation of private companies in the gas supply chain is seen by them as a practice contrary to the interests of the nation. Consequently, the CRE has also been misunderstood, even unnoticed by many of the users it’s responsible for protecting.

But with a little analysis it’s not difficult to appreciate the multiple occasions in which the actions of the CRE have served as a counterbalance to powerful interest groups, anti-competitive policies, institutional inertias that resist technological change, and projects that were far from ever being a model to efficiency.

In December 2018, President Andrés Manuel López Obrador began his six-year term with an energy discourse that was antagonistic to regulators. As part of a restructuring process that included deep budget cuts, in April of this year four of the seven commissioners at the CRE were replaced by professionals with a clear affinity to the new government. Together they already form a strong majority at the new-look CRE. But more change was to come.

In late April, the commissioner with the most years of work as a regulator, Guillermo Zúñiga, announced his resignation from the CRE. And then at the end of May, Guillermo García Alcocer, CRE’s president, announced that he was leaving the post as of June 15.

With two more vacancies to fill, including the presidency, it seems impossible that the CRE will not see a radical change in its interpretation of its legal mandate. It’s difficult to see it distancing itself from the Energy Ministry, for example, and from the demands and aspirations of the state companies in the energy sector. Given the ideological orientation of the government, the state could once again become a hegemonic actor in the energy sector.

But if the constitution does not change — that is, if the energy reform is not reversed — strictly speaking Pemex, state power company CFE and Cenagas are regulated companies that are obliged to report to the CRE. This prevents them from exercising market power.

If a strong CRE is not in place, the assets, resources, coverage and information available to these three companies make them incumbent actors that can relatively easily exercise strategic behavior to eliminate competitors, monopolize end-users and privilege projects. If they also act in a coordinated manner without regulation as a counterweight, the space for other companies to generate value in the gas industry will be either subordinated to the convenience of the state companies’ needs, or limited to private agreements.

To achieve competition in the gas market, transport infrastructure must be in place with sufficient capacity; effective and mandatory open access schemes must exist to those systems; and a tariff scheme is required that allows adequate and reasonable remuneration of costs and investment while encouraging the efficient use of capacity. The CRE is in charge of ensuring that these conditions are present in the sector. The CRE is also in charge of designing mechanisms to achieve these conditions.

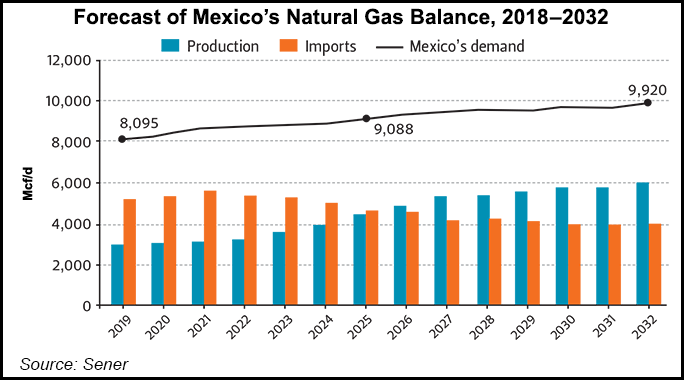

Let’s take the case of sufficient capacity to understand the importance of the CRE. In theory, the transport capacity of the gas network in Mexico is equivalent to 14.5 Bcf/d. Effective demand, without taking into account Pemex demand to produce oil, is just over 6 Bcf/d. It would seem sufficient capacity is in place. But that’s not the case.

The 14.5 Bcf/d figure is the sum of individual capacities of the pipelines in Mexico, but not all pipelines have access to all users and available production basins. A systemic benefit only occurs if pipelines are interconnected for the purposes of improving safety, reliability and efficiency. An interconnected system is then an aim of the regulator, but is an interconnected system convenient to the interests of Pemex?

Not necessarily, especially if Pemex lacks a dominant position along these routes.

If Pemex lacks a captive market, it must reserve capacity for commercial flexibility and that implies fixed costs that can’t be transferred if competitors are able to better manage capacity. In accordance with current regulations, the CRE must approve the expansion of the gas network based on cost-benefit studies. A CRE that considers the “strengthening” of Pemex as part of its mission might not welcome a more robust and flexible system.

For open access to occur and benefit competition, it must be mandatory, and non-discriminatory. Open access has existed since 1995. If it didn’t happen until 2017, it was because there were no guarantees that such access would not be non-discriminatory. The independence of the operator is an imperative condition to this. The new law pays special attention to the issue of conflicts of interest. Close operational coordination between Cenagas and Pemex can generate the perception that the operator is no longer independent, and that a shipper other than Pemex can no longer be sure that it will be treated in a way that is not unduly discriminatory. An operator close to Pemex must make it clear that it will not allow the gas traded by Pemex to take priority over other users.

The CRE as an impartial arbitrator puts the accountability mechanisms in place to ensure that Cenagas as a manager is fair in the allocation of transport capacity and in the application of imbalance mechanisms. A CRE subservient to a centralized strategy can argue that it is better to have a coordinated, single supplier, and so conditions will be set to disfavor marketers in competition with Pemex.

The tariffs established by the CRE are also key. Agents have the right to negotiate other terms and other considerations to the regulated tariff, but CRE’s tariffs will always be a reference point, a summary of the way in which the regulator understands the concepts of cost efficiency, reasonable profitability and risks. It’s important that the way in which tariffs are determined is not distorted by political objectives.

Tariffs do not emerge from a vacuum. If successful, they recover sufficient resources to maintain the pipeline network in good condition to achieve reliability and foster economic activity. Failure to raise rates will only put financial pressure on companies, and in the long run it may imply the commitment of public resources to compensate for lags in maintenance and investment. The financial sustainability of pipeline systems is more important than helping a particular company, even if it is state-owned.

Price controls meanwhile would be a U-turn to the liberalization of the price of gas and would be a way to keep marketers away from the Mexican market.

The list of problematic examples of poor regulation can be very long. The message is more concise. A regulatory body with heterogeneous views is more useful to the state, although not necessarily to the good of the country. The North American regulator, FERC, obeys rules that prevent all commissioners from belonging to a single party. In Mexico such rules do not exist. The definition of what the CRE will be is in the hands of the president.

There are two new vacancies to fill at the CRE. The president can opt for commissioners from outside the ruling party to help give certainty to private investment and peace of mind to those agents who ventured to invest in Mexico after the energy reform. Or, loyalists might fill those spots, creating risks that in the long run will make gas supply more expensive for the entire Mexican market.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 | ISSN © 1532-1266 |