E&P | NGI All News Access | Permian Basin

Cimarex Committed to ‘Living Within Cash Flow,’ Pivoting to Permian

Denver-based Cimarex Energy Co. said it will cut its capital budget for 2019 and pivot to developing assets in the Permian Basin over the Midcontinent, but it won’t drop any rigs as it looks to grow its total production by double digits.

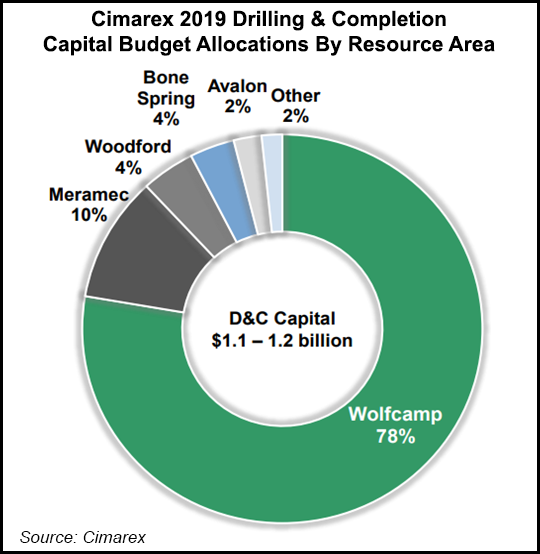

The exploration and production company (E&P) unveiled a capital program of $1.35-1.45 billion, an 11% decrease at the midpoint from 2018. The budget includes $1.1-1.2 billion for drilling and completion (D&C) costs.

“We are absolutely committed to living within cash flow, and that means we don’t want to borrow money,” CEO Tom Jorden said during a quarterly earnings call Thursday. “We didn’t want to come in with capital flying close to the ground because, if we were to go over that number, we would end up going into a debt situation. So we’ve actually built in a little money into our program for potential cost overages. We see them every year.”

Of the D&C capital, about 85% would be devoted to the Permian and 15% to the Midcontinent. By comparison, Cimarex spent 70% of its $1.57 billion exploration and development budget for 2018 on the Permian, with 30% in the Midcontinent.

“Without a doubt, given the disparity between oil and gas prices, the Permian shines relative, in a portfolio matter, to our Anadarko Basin,” said exploration chief John Lambuth. “We have much better oil opportunities in the Permian than we do in the Anadarko. That said, there are oilier opportunities in the Anadarko.”

Lambuth said Cimarex isn’t under any obligation to spend capital to maintain its acreage position in the Anadarko. “We still have a pretty significant amount of capital that has to be deployed in the Permian…We’re happy to deploy it, to maintain our acreage position. All of that led to this year’s investment decision now.

“I will tell you, in the Anadarko, we are challenging that region to come up with the type of development projects that will compete with the Permian. We’ll be working on that throughout the year.”

Cimarex projects 2019 production will average 250,000-270,000 boe/d, with oil production expected to average 78,000-88,000 b/d. Year/year (y/y) production is expected to grow 13-22%, led by oil growth of 15-30%. It plans to continue with an 11-rig drilling program, with 10 rigs deployed in the Permian and one in the Midcontinent.

The E&P plans to bring 83 net wells online in 2019, with an average lateral length of 9,050 feet. It plans to bring six net wells online in 1Q2019, followed by 33 wells in 2Q2019, 23 wells in 3Q2019 and 20 wells in 4Q2019. By year’s end, Cimarex projects it will have 34 net wells awaiting completion.

Cimarex reported production of 251,254 boe/d in 4Q2018, a 25% increase from the year-ago quarter. Production in the Permian (147,404 boe/d) and the Midcontinent (103,432 boe/d) in 4Q2018 increased 31.4% and 17.2%, respectively, from 4Q2017. Full-year production averaged 221,946 boe/d in 2018, up 16.6% from 2017. Permian production increased 20% to 126,124 boe/d in 2018, while Midcontinent production increased 12.4% to 95,307 boe/d.

Increases in natural gas liquids (NGL) production outpaced simultaneous increases for oil and natural gas. NGL production averaged 67,706 b/d in 4Q2018 and 60,258 b/d for the full-year 2018, equating to a quarter/quarter (q/q) increase of 35.5% and a year/year (y/y) increase of 26.6%. By comparison, oil averaged 79,904 b/d in 4Q2018, a 29.3% q/q increase, and 67,699 b/d in 2018, an 18.5% y/y increase. Natural gas production averaged 621.9 MMcf/d in 4Q2018, a 16.5% q/q increase, and 563.9 MMcf/d in 2018, up 9.8% y/y.

The company placed 38 net wells into production in 4Q2018, including 32 in the Permian and six in the Midcontinent. The Permian wells targeted the Wolfcamp, Avalon and Bone Spring formations. One well highlighted was a test in Culberson County, TX, the Kingman 45 State Unit 3H, which targeted the Third Bone Spring with a 10,000-foot lateral. The well recorded an average 30-day initial production (IP) rate of 2,917 boe/d (67% oil).

“This outstanding result continues to expand the perspective hydrocarbon window for the Upper Wolfcamp in Culberson County, which will lead to greater development well densities for this area,” said Lambuth.

During 2018, Cimarex brought 122 net wells into production, 80 in the Permian and 42 in the Midcontinent. The company had 28 net wells awaiting completion at the end of 2018 — 20 in the Permian and eight in the Midcontinent.

Last September, Cimarex closed on the sale of about 28,000 net acres in Ward County, TX, to a subsidiary of Callon Petroleum Co. for $544.5 million. Two months later, the company agreed to purchase Resolute Energy Corp. in a cash-and-stock deal valued at $1.6 billion. The acquisition is expected to close on March 1, subject to approval by Resolute shareholders and regulatory requirements.

Cimarex reported net income of $316.2 million ($3.32/share) in 4Q2018, compared with $174.7 million ($1.83) in the year-ago quarter. For the year, net income was $791.9 million ($8.32), versus $494.3 million in 2017. Quarterly operating revenues totaled $624.1 million, up from $550.9 million in 4Q2017. Full-year operating revenues totaled $2.3 billion, up from $1.9 billion in 2017.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |