Markets | NGI All News Access | NGI Data

Christmas for the Bulls? Colder Temps, Stout Draws Lend Gas Price Support

Coming off a much warmer than normal weekend in which a number of eastern population centers welcomed the official start of winter with temperatures in the high 60s to low 70s, the return to more seasonable cold on Monday, with forecasts of more to come, saw the value of physical gas traded for Tuesday delivery increase at nearly all points across the country.

With less than a week to go before expiration on the Christmas-shortened trading week, January natural gas futures also sprung higher Monday as near-term forecasts show more winter-like temperatures ahead for much of the country. The front-month contract added 4.5 cents to close out the day’s regular session at $4.463, while February futures added 5.2 cents to $4.519.

While most points tacked on anywhere from a dime to 30 cents, there were a handful of $1-plus gainers and a couple of capacity constrained northeastern trading locations that ballooned by more than $7. After dropping by $2.24 and $2.74 respectively on Friday for weekend and Monday delivery, Algonquin Citygates and Tennessee Zone 6 200 Line on Monday for Tuesday delivery bounced back to add $7.94 and $8.34 respectively to average $13.79 and $14.00.

Gas values at the Henry Hub continued to set two-and-a-half-year highs on Monday as the location added 17 cents to average $4.52. Gas at the hub hasn’t traded higher since July 21, 2011, when it averaged $4.58.

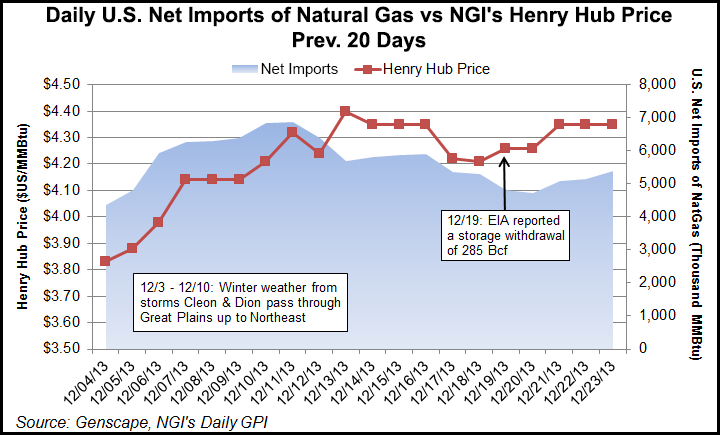

Following the unseasonably warm temperatures seen over the past week, U.S. net imports of natural gas began to tick up over the weekend, rising from 4,732 MMBtus on Friday flow to 5,391 on Monday, according to Genscape flow data. Most of this rise was due to increasing Canadian imports at points like Emerson (Viking).

NGI Markets analyst Nathan Harrison said the stars are beginning to align for the price bulls. “An increase of gas imports, combined with last week’s record storage draw report of 285 Bcf, would certainly seem bullish for natural gas prices in the near-term — depending of course on how the winter weather outlook plays out,” he said.

Ritterbusch and Associates’ Jim Ritterbusch similarly sees the bulls in a position of control. “This market is seeing some renewed buying at the start of this new week and we look for pullbacks to prove brief and limited as the supply shortfall continues to stretch,” he said Monday. “While last week’s huge draw of 285 Bcf has been well discounted, we feel that another sizable decrease will be forthcoming on Friday that could further stretch the year-over-year deficit by another 100 Bcf or so with a 600 Bcf shortfall possible.”

He added that temperature forecasts are appearing “more bullish” than on Friday with below normal temperature patterns well entrenched across the eastern half of the U.S. through the first week of January.

“Until some sustainable warming is seen, line of least price resistance will remain tilted to the upside and fresh price highs would appear likely heading into Friday’s EIA storage report,” he added. “In addition to the obvious demand implications for this cold month of December, production freeze offs have evolved as a significant ingredient within the balances as was seen in last week’s data. While we still anticipate a return to a record production pace next month, we have taken our bearish checkmark off of the production factor for the time being.”

Ritterbusch said he expects price strength to be sustained during the week with upside possibilities extending up around $4.610 basis January futures, which expires Friday. “In short, this bull move remains much alive and higher prices would appear to lie ahead.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |