Markets | LNG | NGI All News Access | NGI The Weekly Gas Market Report

China’s U.S. LNG Imports Tanked in 4Q; Rebound Seen on Long-Term Supply Deal

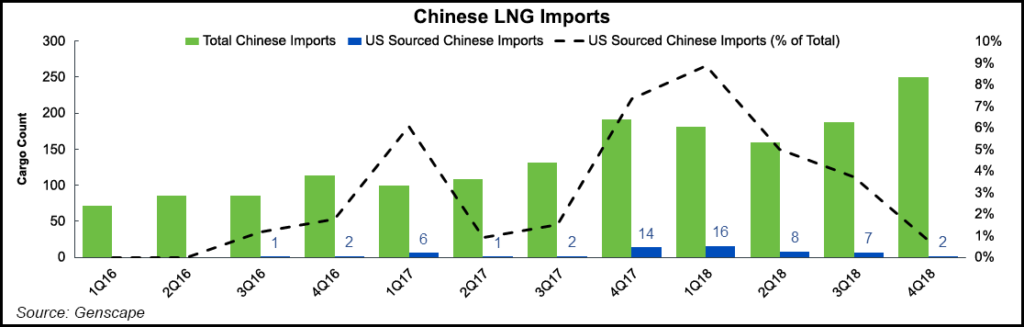

China imported only two of the 69 liquefied natural gas (LNG) cargoes sent from the United States in the fourth quarter of 2018, a dramatic fall from the 14 U.S. cargoes it imported a year earlier after a trade war erupted last fall, according to Genscape Inc.’s proprietary monitoring data.

Still, analysts expect imports to rebound this year as a 25-year deal between Cheniere Energy Inc. and China National Petroleum Corp. gets underway and the current U.S. tariff freeze on Chinese imports ends.

China last fall imposed a 10% tariff on U.S. LNG as part of a tit-for-tat trade war that remains ongoing. While the tax on U.S. LNG was lower than the original 25% expected, the effect on cargoes sent to China was clear.

Even as China’s imports of U.S. LNG rose to 33 cargoes in 2018 from 23 in 2017, the two cargoes it imported in 4Q2018 were down from the seven it imported in 3Q2018 and represented only 7% of the country’s gas supply, according to Genscape.

“The trade dispute certainly had an impact on the latter half of the year,” Genscape LNG analyst Charlie Cone said.

In addition to the trade war, other factors could have also played a hand in the dramatic decline in U.S. LNG imports. The country’s aggressive coal-to-gas program was implemented in 2017, and the country “had to accelerate LNG imports to meet demand coming out of those conversions. Most conversions had been completed” before 4Q2018.

China imported about 780 cargoes total (about 2.5 Tcf) in 2018, up from the 530 cargoes in 2017 (about 1.8 Tcf) and was on pace to overtake longtime front runner Japan as the top LNG importer in the world. China ranked No. 4 on the list of U.S. importers, with South Korea, Mexico and Japan taking the top three spots.

Meanwhile, on top of the 10% tariff, U.S. cargoes also included the toll cost of the Panama Canal. A standard Panamax LNG tanker runs about $353,000 to pass through the canal, which is about 3% of a Gulf-sourced cargo’s value, before charter costs are considered, according to Genscape.

“This makes it difficult to compete with other suppliers like Qatar and Russia that have the cheapest supplies in the world,” Cone said.

In addition, 2017 was a particularly frigid year and the fourth quarter of 2018 was unusually mild. Northeast Asia saw the odd bout of colder-than-normal weather during December, but long-range forecasts called for a continuation of the moderately warmer-than-normal winter weather that characterised 4Q2018, according to Energy Aspects.

Going into the final three months of last year, analysts argued that the big northeast Asian importers had been busy buying cargoes over the summer for winter 2018/19 so that they would not be caught short.

“With Chinese buyers likely having bought everything they can physically take, and Japan and Korea having hedged at least a normal winter’s worth of gas, the call for spot cargoes has simply not been there over this winter to date,” LNG analyst Trevor Sikorski said.

The underlying soft demand side means that peak winter has so far passed by without enough cold weather to push Northeast Asian buyers to restock. With the contract market close to shifting its prompt focus to March cargoes, “even a late cold spell is unlikely to really roil the LNG markets, as the need to quickly restock will simply not be there,” he said.

Still, Cone is optimistic that China’s imports of U.S. LNG will rebound in 2019. The country has already received one cargo this month, and the 1.2 million metric tons/year supply deal between Cheniere and CNPC is active, meaning another 18 cargoes are expected to follow throughout the year.

“Furthermore, the 10% tariffs will not necessarily eliminate Chinese imports of U.S. spot charters, especially since Henry Hub gas is among the cheapest in the world, and will oftentimes beat out other suppliers, even with the additional costs of transport and tariff,” Cone said.

If no resolution to the trade spat is made, U.S. LNG exports still will likely not falter as “there are still plenty of destinations that can displace the ones from China, even though China is an enormous market,” Cone said.

The tariffs, however, will be more impactful on future investments by U.S. LNG developers. Many have yet to reach final investment decisions (FID) on proposed projects and while some are further along in the process than others, the ongoing tariff situation is detracting investor confidence as a lot of these developers are looking to China to take some of their supply.

“It makes it more difficult for these projects to get funded,” Cone said.

In October, Magnolia LNG LLC, a subsidiary of Australia’s LNG Ltd., pushed back its FID for its proposed export terminal adjacent to the Calcasieu Ship Channel in Lake Charles, LA.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |