E&P | NGI All News Access | NGI The Weekly Gas Market Report

China’s Top Producers Ramp Up Unconventional Natural Gas Volumes

China’s two largest exploration and production companies increased natural gas volumes in the first half of the year, in line with a government mandate to offset coal use.

China National Petroleum Corp. (CNPC), the country’s largest producer, said last Thursday its first half 2019 (1H2019) gas production increased 10% from the same period last year and accounted for 70.3% of China’s total gas production during the period. CNPC said it was the first time its gas output posted double-digit growth in 10 years.

The state-run firm said its 1H2019 gas sales increased 31.7% as it stepped up operations in the high-end market.

China Petroleum and Chemical Corp., aka Sinopec, said its 1H2019 gas production increased by 940 million cubic meters, a 6.8% increase from a year earlier. Gas sales increased by 21.9%, or 3.93 billion cubic meters (bcm).

Total 1H2019 natural gas production in China was 86.4 bcm.The spike in production comes amid Chinese President Xi Jinping’s call for state-owned companies to increase oil and gas reserves and production to bolster national energy security.

CNPC and Sinopec agreed earlier this month to collaborate on large scale upstream exploration and aim to expand their reserves and production capacity in the central and western regions.

CNPC expects its proven gas reserves to reach 3.73 trillion cubic meters. Sinopec has proposed to build a gas field in the Sichuan Basin with annual output of 10 bcm by 2020 and 20 bcm by 2030, driven by unconventional development.

China’s unconventional gas production may double by 2020 to 17 bcm from Sinopec wells in the Fuling development, in addition to CNPC projects in Changning-Weiyuan and Zhaotong, according to a 2018 forecast by Wood Mackenzie.

Beijing has mandated that natural gas make up at least 10% of China’s energy mix by 2020 to help offset rampant air pollution levels from industrial and home heating coal use and to meet the commitments under the United Nations global climate accord in 2015, otherwise known as the Paris Agreement. Beijing has also set further gas earmarks for 2030.

The problem for China, however, is that even with new gas production from its tight gas and shale formations it may be unable to meet demand, leading to more reliance on piped gas and liquified natural gas (LNG) imports.

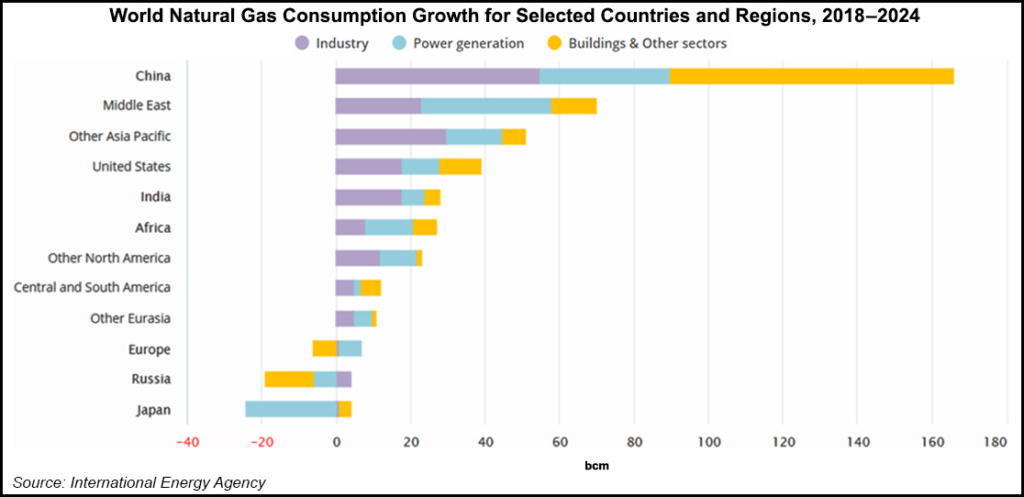

Domestic gas production reached 161 bcm in 2018, but total gas demand for the year reached 280 bcm, according to Energy Aspects. Over the past five years, annual gas production increased by an average 9 bcm (7%), while demand has grown by an average 23 bcm/year. China’s LNG imports are expected to increase to more than 100 bcm in 2024, bypassing Japan, the current top LNG importer, according to the International Energy Agency’s Peter Fraser, head of the Gas, Coal and Power Markets Division. In January, China passed South Korea to become the world’s second largest LNG importer.

The Asia-Pacific region accounts for around two-thirds of global LNG demand, with demand in the region projected to increase in China as well as South Asia, particularly in Pakistan, India and Bangladesh.

Fraser earlier this month also said he expected China’s gas consumption growth to slow to an annual growth rate of 8% through 2024 because of slower economic growth.

China’s economic growth last quarter dropped to its lowest level in nearly three decades, the country’s National Bureau of Statistics (NBS) said this month. China’s 2Q2019 gross domestic product grew at 6.2%, the slowest quarterly growth rate since 1992 and down from 6.4% in the previous quarter.

The country’s economy is expected to continue to face downward pressure as trade tensions between the United States and China continue, the NBS said. The trade war between the two sides marked its one-year anniversary on July 6.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |