NGI All News Access | LNG | Markets

China Trade Row Said Unlikely to Slow U.S. LNG Exports Near Term

China’s decision to enact a 10% tariff on U.S. liquefied natural gas (LNG) is unlikely to slow exports in the near term, analysts said, and a “second wave” of domestic export projects could find buyers elsewhere, especially in Europe and Asia.

Meanwhile, sponsors of the public corporation planning to build a second wave project in Alaska expressed confidence that the trade row “will be resolved well in advance” of exports to China, and despite tensions, it continues to work with three Chinese companies that agreed to finance the project last year.

China enacted the tariff in retaliation to the Trump administration’s decision Monday to enact tariffs on another $200 billion of Chinese products. The White House said a 10% tariff on products imported from China would take effect Monday (Sept. 24) and increase to 25% after Jan. 1.

Barclays Commodities, in a note to clients Wednesday, said the market reacted with relief to the news that Beijing would tax U.S. LNG at 10%, rather than 25%, which it had suggested last August. Shares of LNG exporters Cheniere Energy Inc. and Tellurian Inc. climbed Tuesday on the New York Stock Exchange and Nasdaq, respectively.

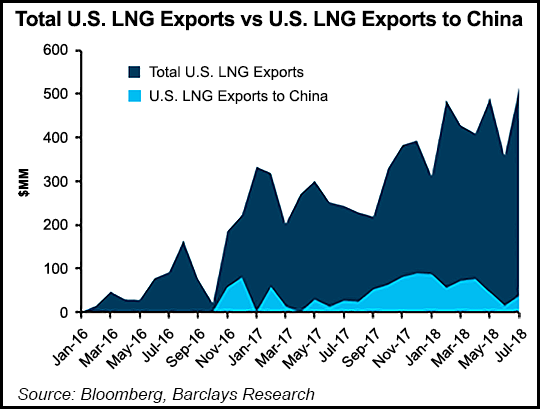

However, there is a general consensus that the escalating Sino-U.S. trade war would not derail U.S. LNG exports in the near term. According to Barclays, U.S. Census Bureau data show Chinese imports of U.S. LNG peaked last December and declined nearly 60% through July, the most recent month with figures available. China accounted for just 7% of total U.S LNG exports in July.

“Chinese buyers likely saw the writing on the wall and moved to source from other countries,” Barclays analysts said. “Thus, we do not expect U.S. LNG exports to be materially affected, as volumes will likely be rerouted to other countries.”

Wood Mackenzie’s Giles Farrer, research director for global gas and LNG supply, concurred. He said in the 12 month-period that ended in June, China was the second-largest buyer of U.S. LNG, purchasing about 3 million metric tons/year (mmty), and Royal Dutch Shell plc was Beijing’s largest seller. Since then, China has been gradually reducing its U.S. purchases.

“The impact on the short-term market is likely to be less than we previously indicated,” Farrer said in a note Wednesday. “This is partly because the level of the tariff is lower than initially proposed, but also because we think China has already completed the majority of its procurement for winter.

“Possibly because of this, we have recently seen spot and futures prices for winter come down despite strengthening oil prices.”

Farrer said if China still needed to procure spot cargoes, it would likely be from “lean sources” of LNG, including projects from Australia’s east coast, the Tangguh LNG project in Indonesia, the Gorgon LNG project in Western Australia, or the mega trains at Qatar’s Ras Laffan Industrial City. However, these sources could charge a premium of up to 10%, he noted.

“Chinese buyers’ appetite to pay significantly higher prices for LNG from other sources may be limited by the price they can sell gas domestically,” Farrer said.

Still, Barclays analysts said China is expected to be the largest driver of LNG demand growth. The firm said Beijing’s year-to-date imports of LNG are up 29% year/year, mostly from the government’s efforts to address air pollution by boosting gas use in its cities and investing in LNG infrastructure.

“We expect China to account for the majority of global LNG demand growth in the coming years,” Barclays analysts said. China’s 10% tariff on U.S. LNG “makes life harder, but not impossible, for ‘second-wave’ U.S. LNG projects.” Canada, Qatar, Russia and other countries could benefit from the Sino-U.S. trade row.

“We expect the increased uncertainty to slow, but not stop, the pace of signing of new offtake contracts for U.S. projects,” Barclays analysts said. “Three deals signed this month suggest that the two countries will aim to work out agreements with other partners first.”

Earlier this month Venture Global LNG, which is planning two U.S. Gulf Coast export projects, signed a 20-year sales and purchase agreement (SPA) with Spain’s Repsol SA, and a 22-year SPA between PetroChina and Qatargas was signed three days later. Switzerland’s Vitol Inc. announced a 15-year SPA on Monday with Cheniere, which has the Sabine Pass LNG project in Louisiana and is nearing startup for the Corpus Christi liquefaction facility in South Texas.

Farrer said in the long-term, new supply projects may suffer. The trade dispute “restricts the target market for developers of new U.S. LNG projects trying to sign new long-term contracts. However there is still plenty of appetite for second wave U.S. LNG projects from other buyers in Asia and Europe.” He cited the Venture Global and Cheniere deals, as well as a 20-year liquefaction tolling agreement between Freeport LNG that is planned for the Texas coast and a subsidiary of Japan’s Sumitomo Corp.

“The first wave of U.S. LNG projects was successful despite not signing contracts with Chinese buyers,” Farrer said. That said, the ongoing trade spat “could also support development of other projects outside of the U.S. targeting the Chinese market, including Russia pipeline projects, potentially allowing them to push for higher long-term contract prices. The recent deal between PetroChina and Qatar is evidence of this.”

Analysts with ClearView Energy Partners LLC weighed in Tuesday, noting that impacts from the ongoing trade dispute with China are starting to appear in the U.S. energy sector. ClearView cited the four-year tariff on Chinese solar panels and modules enacted by the Trump administration last January, as well as a 25% tariff on steel and a 10% tariff on aluminum imported from China, in effect since May 1.

“We see early indications of energy-sector impacts from steel tariffs — and reprisals, especially against ethanol — and [from] solar tariffs,” ClearView analysts said. “Tariffs may also be slowing U.S. propane exports to China.”

Alaska LNG Still Advancing

The state-backed Alaska Gasline Development Corp. (AGDC) still expects to complete the Alaska LNG project, which has been estimated to cost $43.4 billion. As designed, it would have capacity for up to 20 mmty of LNG.

AGDC spokesman Jesse Carlstrom told NGI on Wednesday that the public corporation “expects the current trade tensions between the United States and China will be resolved well in advance of Alaska LNG exports to China.

“The Alaska LNG project represents a multigenerational project that matches China’s natural gas demand with Alaska’s natural gas supply on the North Slope. As a result, Alaska LNG will continue to present a win-win opportunity for both countries.”

According to Carlstrom, Alaska LNG “offers Chinese buyers a unique advantage over other U.S. LNG export projects.” As examples, he cited the bounty of the anchor fields of Prudhoe Bay and Point Thomson, on Alaska’s North Slope, which collectively hold 30 Tcf of proven reserves, as well as the project’s proximity to the Asia-Pacific region.

Last November, AGDC signed a joint development agreement (JDA) with China’s state-owned Sinopec Group, the Bank of China and China Investment Corp. to help develop Alaska LNG.

“Despite the current trade issues between the United States and China, AGDC continues to work with its Chinese counterparts to advance the technical and commercial framework of Alaska LNG because the project presents an opportunity for both sides to succeed,” Carlstrom said. In addition to the JDA, “AGDC is progressing commercial negotiations with 15 other large LNG buyers, including Tokyo Gas Co. Ltd., Korea Gas Corp., PetroVietnam Gas and others.”

FERC announced at the end of August that it would accelerate its review schedule for Alaska LNG [CP17-178]. The Federal Energy Regulatory Commission plans to issue a draft environmental impact statement (EIS) in February, followed by a final EIS possibly in November 2019, accelerating the original schedule

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |