China May Extend Unconventional Natural Gas Subsidies

China is considering extending subsidies for unconventional natural gas development through 2025, as the government looks for ways to support the nascent industry.

In a translated policy statement to other entities within Beijing’s centrally planned government, the State Council said China’s current systems for natural gas production, supply and marketing are “still incomplete. The problem is that the insufficient industrial development imbalance is growing more prominent, mainly because the domestic production growth rate is lower than the consumption growth rate.”

It added that the “diversification of natural gas imports needs to be enhanced,” and there are “security risks in the construction and operation of facilities.”

Among a list of 12 suggestions for how to address the issues, the council said “the central government’s policy on subsidies for unconventional natural gas will be extended to the ”14th five-year’ period, and tight gas will be included in the scope of the subsidies.” The five-year period is from 2020-2025.

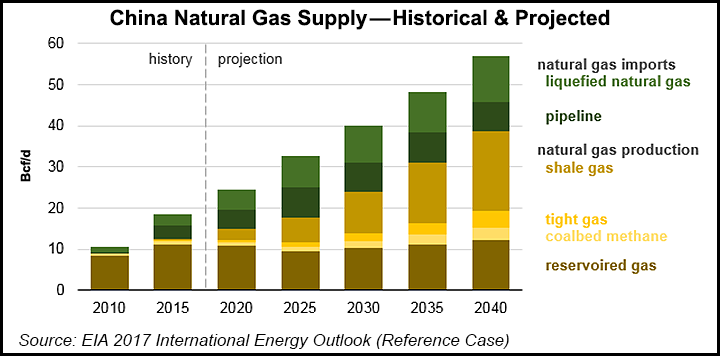

Beijing wants to strengthen its exploration and production efforts. “All oil and gas companies have increased their domestic exploration and development funds and workloads to ensure the completion of the national planning and deployment tasks, and strive to achieve domestic natural gas production of more than 200 bcm [7.06 Tcf] by the end of 2020,” the council said.

Other suggestions included building a multi-level reserve system, which would include liquefied natural gas (LNG) facilities, both along China’s coast and its inland provinces. “By 2020, urban gas-fired enterprises will have a gas storage capacity of no less than 5% of their annual gas consumption,” the council said. Beijing also plans to accelerate the construction of natural gas pipelines, LNG receiving stations.

China has previously announced plans to double the amount of natural gas in its primary energy mix to 10% by 2020, according to a directive jointly published by 13 governmental agencies. But aside from LNG import terminals, much of China’s pipeline infrastructure was built for domestic gas or imports from central Asia. China National Petroleum Corp., the largest state-owned producer of oil and natural gas in the country, also reportedly plans to nearly double gas production from shale sources this year and wants a five-fold increase in such production by 2020.

Last April, analysts with Wood Mackenzie estimated that China’s unconventional natural gas production would reach 17 bcm (600.3 Bcf) by 2020.

But China’s plans could be blunted by ongoing Sino-U.S. trade tensions. Last month, China imposed a 25% tariff on a range of American-made goods valued at $16 billion, including coal and petroleum products, in retaliation for the Trump administration levying a tariff of similar size and scope on the same day. Although crude oil and LNG have not yet been targeted, analysts believe they could if the White House were to move forward with a 25% tariff on additional $200 billion worth of Chinese imports.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |