Infrastructure | LNG | NGI All News Access | NGI The Weekly Gas Market Report

Chevron, Woodside Want to Double Size of BC LNG Export Project

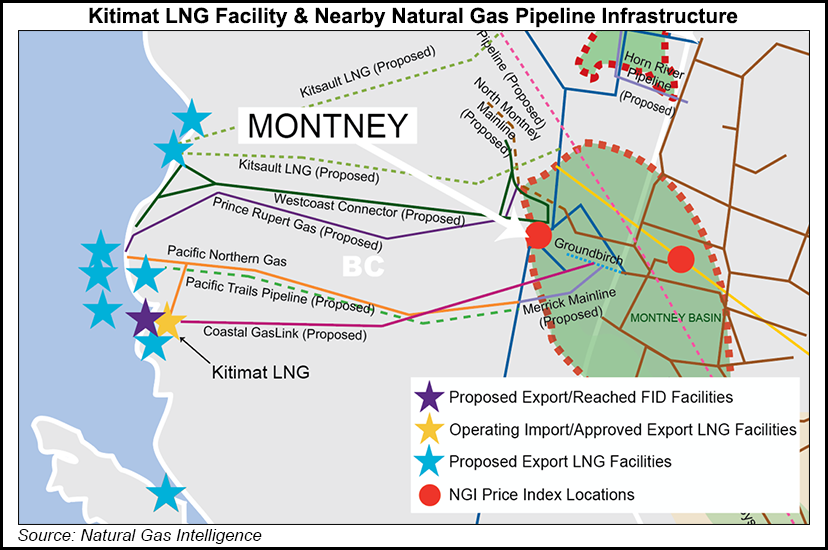

Chevron Canada Ltd. and Woodside Energy Ltd. in an export license application to the National Energy Board (NEB) have doubled the size and intended lifespan of KM LNG, their planned natural gas project for offshore British Columbia (BC).

The partners requested a 40-year authorization to load liquefied natural gas (LNG) tankers on the northern Pacific coast at Kitimat with up to 2.7 Bcf/d. The project’s first license granted a 20-year term for 1.3 Bcf/d.

The enlarged second edition of KM LNG still sets no construction or completion target dates. Chevron and its Australian partner, which each own 50% in the joint venture, also disclosed no new cost estimates or gas supply arrangements.

Instead of laying a schedule, the new export license application seeks to keep the project’s options open by requesting a long sunset clause. The permit would allow shipments to begin at anytime for 10 years following its approval date.

Apache Corp., Chevron’s original partner in a Kitimat export project, in 2014 sold its half-stake to Woodside. In 2015, Woodside and Chevron were authorized by NEB to ship 28.5 Tcf of gas over 25 years at a rate of up to 4 Bcf/d from a terminal proposed on the northern Pacific coast at Grassy Point, north of Prince Rupert.

The current export license for the original proposal expires at the end of this year. However, the project retains federal and provincial environmental approvals, a terminal site lease and benefits agreement with the Kitimat native community.

Costs of the original, half-sized KM LNG were estimated at C$5.6 billion ($4.2 billion), including C$4.5 billion ($3.4 billion) for the Kitimat terminal and C$1.1 billion ($825 million) for a pipeline to northern BC gas wells.

Even the doubled volume and lifespan of the new project version would not strain gas supplies for Canadians, predicted a report on surpluses available for export that KM LNG commissioned by former NEB Chairman Roland Priddle.

“The capability of the resource will not be the limiting factor,” Priddle wrote in his retirement role as an elder statesman of energy consulting. “On the contrary, the limitation on gas supply will continue to be the availability of economic markets available to Canadian gas producers.”

Priddle recited records kept on dramatic supply growth across North America by the NEB, U.S. Energy Information Administration, U.S. Potential Gas Committee, and Canadian federal and provincial earth-sciences agencies.

Thanks to “the shale gas revolution,” current and still growing resource totals recognized in Canada, the United States and Mexico soared into an astronomical range of 3,910-4,591 Tcf: 879-1,560 Tcf in Canada, 2,463 Tcf in the United States and 600 Tcf in Mexico.

KM LNG’s total 40-year export license request, 35 Tcf, is only 0.8-0.9% of a continental gas endowment that is readily available from a highly developed pipeline network spanning the United States and Canada.

“It is impossible to project any price impact arising from Chevron’s small [KM LNG] proportion of the total market: 2.7 Bcf/d on a North American market which is now approaching 100 Bcf/d and which by the 2060s may approximate 170 Bcf/d,” Priddle wrote.

“There is no reason to expect that over the coming 50-plus years…today’s sound market fundamentals will be impaired,” he added. “The policy, regulatory and commercial underpinnings of those fundamentals in both countries are sound and can reasonably be expected to endure, indeed to be enhanced.”

The Chevron-Woodside news comes only days after the BC government delivered on a promise of up to C$6 billion ($4.5 billion) in aid for the first LNG export project to enter construction. LNG Canada, sanctioned last fall also in Kitimat, is receiving favorable corporate income and sales tax cuts for the consortium led by a unit of Royal Dutch Shell plc.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |