Earnings | Coronavirus | NGI All News Access

Chevron Warns Pandemic Threatening Through September, but Common Ground in Election

Chevron Corp., savaged in the second quarter by the hurricane-force winds of Covid-19, warned Friday that the pandemic may choke profits through September.

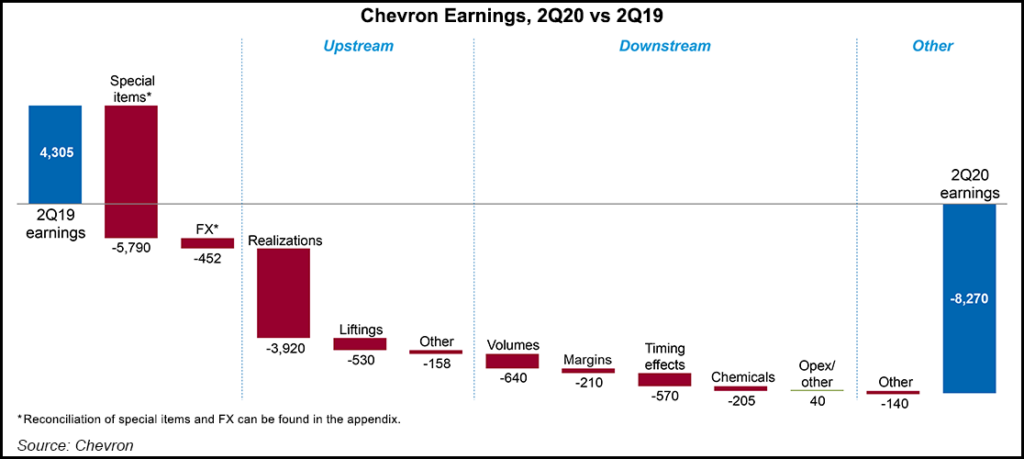

The San Ramon, CA-based major posted an $8.3 billion loss (minus $4.44/share), compared with net profits a year earlier of $4.3 billion ($2.27). U.S. upstream operations lost $2.1 billion, versus year-ago earnings of $896 million.

One-time charges took their toll on the bottom line, with nearly $5 billion of impairments. They included $2.6 billion to write off the entire Venezuela portfolio, as well as a severance charge of $780 million from laying off about 6,000 people, an estimated 13% of the global workforce.

Another $1.8 billion was written down for the value of its oil and gas portfolio, as U.S. realized liquids prices plunged to an average $19/bbl from year-ago prices of $52. Average natural gas prices rose, but only to average 81 cents/Mcf, versus 68 cents in 2Q2019.

Common Ground

Upstream chief Jay Johnson and CFO Pierre Breber shared a microphone on Friday to discuss the results. They also took some time to answer an analyst’s question about the November election, which will pit President Trump against presumptive Democratic nominee Joseph R. Biden.

No matter who is elected president, Chevron expects to do well, they said. Management works well “at the federal, state and local levels in this country with the government of both parties,” Breber said. “And of course we work with governments of different parties all around the world where energy is essential.”

The global economy’s recovery is going to be the No. 1 priority once the pandemic has eased, said the CFO, “and we think energy will be a big part of that.”

Chevron already has committed to a variety of environmental, societal and governance issues, aka ESG, including to reduce carbon intensity in its operations. The swing to more renewables also has prepared the organization to compete in any political world, as it integrates renewable natural gas and renewable liquid fuels into its portfolio.

“We intend to be in business for a long time,” Breber said, “and we intend to be a constructive force wherever we operate, to be a good partner with whoever is governing at that time. And we think there’s a lot of common ground that we can find between what we do as a company and what governments aspire to do.”

Johnson said “there is actually a lot of common ground with where the potential administrations want to go because we’ve already been focused on reducing flaring and methane emissions, our greenhouse gas intensity…We’ve had a head start on this…” Energy industry jobs also are an important part of the U.S. economy, he said.

In addition, “our emphasis on natural gas as a bridging fuel continues to support our operations in both the Gulf of Mexico and Permian stay focused on reducing the impact that we have as we produce these essential products.”

“So we’ll continue to focus on reducing emissions and lowering our carbon footprint. But at the same time, we’re going to continue to work with whatever administration is in place and work to make sure that there is a good understanding of potential regulation and the impacts that may have as we move forward.”

Permian Power

Worldwide production fell 8% sequentially and 3% year/year to 2.99 million boe/d, mostly from curtailing output and from asset sales.

However, in the United States, output climbed to 991,000 boe/d net, up 93,000 boe/d year/year. Production increases from shale and tight properties in the Permian Basin in Texas and New Mexico were partially offset by normal field declines and the effects of production curtailments.

Liquids output from the Permian climbed from 2Q2019 by 5% to 747,000 b/d, while natural gas production increased 29% to 1.46 Bcf/d.

Still, “the short-term outlook…has changed as a result of the lower capital spending,” Johnson said of the Permian. “After curtailments in May and June, we’re back to full production and expect second half production to be in line with the first half at current activity levels.”

Still, the worst may not be over. While demand and commodity prices have shown signs of recovery, they are not yet at pre-pandemic levels. Financial results could be depressed through September.

More quarterly earnings coverage by NGI can be found here.

Going into 2021, Permian output is set to decline year/year by 6-7%, Johnson told analysts. “The near-term production profile for the Permian has changed, but our long-term view of the assets’ attractiveness has not. With our scale, efficient factory drilling and royalty advantage, we believe we’re well positioned to maximize returns and deliver value.”

Chevron also is looking to integrate the Noble Energy Inc. portfolio once the newly announced merger is completed. The tie-up would bolt-on Permian acreage, build a Denver-Julesburg Basin portfolio and add some natural gas-heavy assets in the Eastern Mediterranean.

Meanwhile, the Gorgon liquefied natural gas (LNG) export project in Australia has undergone some hiccups. The second train scheduled to restart in mid-July was moved forward to September.

“Our fundamental concern is operating safely and reliably, and we’re always going to take decisions in alignment with that as part of our normal operations,” Johnson said. “We take trains down for turnarounds to do inspections and maintenance.”

During the Train 2 turnaround, some well defects in the propane heat exchangers were discovered. The repairs are proceeding. The train should be “up running in early September. All the other planned work for the turnaround has already been completed.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |