Using the financial muscle of its global natural gas and oil portfolio, Chevron Corp. is tripling its investments in low-carbon ventures with an eye on becoming a force in renewable fuels, hydrogen, carbon capture and offsets.

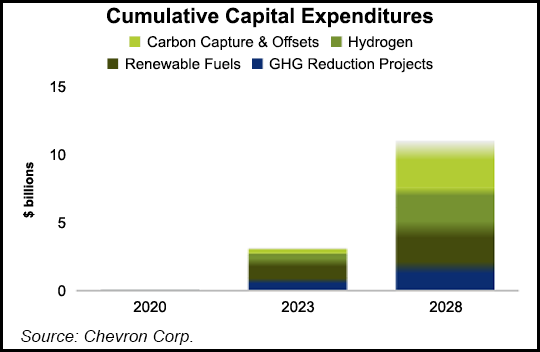

The nation’s No. 2 oil producer on Tuesday pledged to earmark $10 billion in capital spending for low-carbon opportunities through 2028, sharply up from its previous target of $3 billion.

It’s more than doable, CEO Mike Wirth told investors during a strategy presentation with his executive team.

“We don’t lay out ambitions that are not deliverable,” he said. “The planned actions target sectors of the economy that are harder to abate and leverage our capabilities, assets and customer relationships.”

Investors “are seeing a divergence...