Shale Daily | E&P | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

Chevron Touts Permian Power

U.S. onshore results may have been lost in the weak second quarter performance by Chevron Corp., but the No. 2 U.S. producer had a strong story to tell about its onshore portfolio, particularly the venerable Permian Basin.

Chevron posted a quarterly loss of $1.5 billion, versus year-ago profits of $571 million. However, for onshore enthusiasts, the Permian was a good news story, where well development costs are falling, laterals are longer and production is growing.

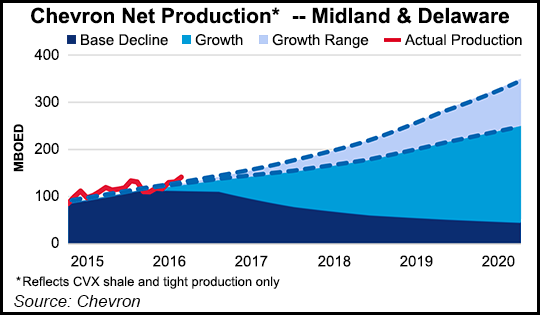

Chevron’s Permian production between April and June jumped 21%, or 24,000 boe/d, from a year ago. Meanwhile, development costs, including for drilling and completion, fell to about $10/boe from $20.

Results are strong enough and efficiencies good enough that the San Ramon, CA-based producer is increasing its Permian rig count.

“We continue to want to grow our Permian business,” Chevron’s upstream chief Jay Johnson said Friday during a conference call. “We are adding an additional rig in August. We expected to have an additional four rigs, going from six to 10, by the end of this year in the Permian, and we would expect to see good performance coming from those rigs.

“One of the things we’ve tried to do is take a measured pace, so that we can preserve the productivity and the capital efficiency that we’ve been able to capture so far. We want to make sure we do that so that as we ramp up, we feel quite confident that we can do so.”

Chevron now is “staffing up and ramping up activity levels” in the Permian, and the “bias on this is upwards going forward.”

What gives Chevron an automatic leg up in the Permian is its royalty rate, established decades ago in the legacy leasehold that stretches across two million acres from West Texas into northern New Mexico. Chevron is working around one million acres in the Delaware sub-basin and another 500,000 in the Midland sub-basin.

Most important is the fact that around 85% of the leasehold has no or low royalty rates of $5/bbl and below — less than half that of any other competitor working across the basin. Most operators have reduced their operating costs across the board but the royalty rate is Chevron’s secret sauce.

“I think we’re now fully competitive with other players,” Johnson said. “We’re not flashy but we’re steady. We are taking all the learnings in…and being methodical…Add in the advantaged royalty position, if we stay focused, we can ramp up the number of company-operated rigs and do so in a manner to allow efficiencies…”

Chevron is taking some of the best practices from the Permian and “spreading them across the portfolio,” including in the western Pennsylvania’s Marcellus Shale and Canada’s Duvernay formation.

For a full listing of 2Q2016 industry earnings calls, including links to NGI‘s coverage of both the company and the call, see NGI’s2Q16 Earnings Calls List PDF.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |