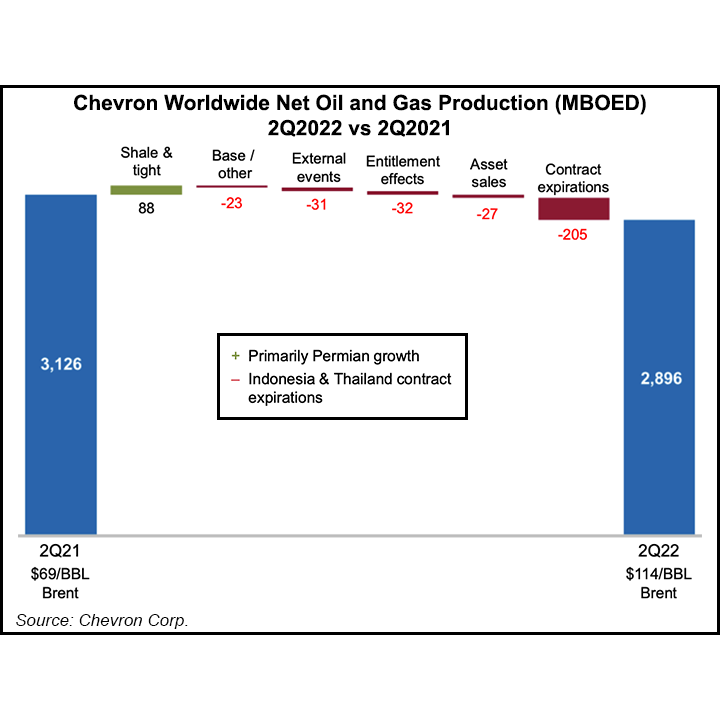

The Permian Basin is driving U.S. oil and gas production growth for Chevron Corp., helped by low development costs, substantial efficiency improvements and low carbon intensity, management said Friday.

CFO Pierre Breber and Executive Vice President of Upstream Jay Johnson hosted a conference call to discuss the San Ramon, CA-based major’s second quarter earnings.

Amid resurgent energy demand, Johnson told analysts that Chevron’s investment in the basin this year is forecast to be “$1 billion higher than it was last year, and we also see the number of wells that we’re putting on production going up.”

Chevron expects to turn more than 200 wells to production in the Permian this year, driving a roughly 15% year/year increase in production to between 700,000 boe/d and...