Shale Daily | E&P | NGI All News Access | NGI The Weekly Gas Market Report

Chevron Launching Extended Duvernay Drilling Campaign

After three years of field trials, extended supply development is beginning on Western Canada’s second shale gas frontier in the Kaybob Duvernay area of west-central Alberta by a unit of Chevron Corp.

Pembina Pipeline Corp. announced Monday it would construct a C$290 million ($230 million) first stage in processing facilities for a long-range drilling campaign by Chevron Canada Ltd. in the Duvernay geological formation.

“The Duvernay formation is one of the most prospective liquids-rich shale plays in North America,” said Chevron Canada President Jeff Gustavson.

Chevron and Pembina earlier this year inked a 20-year field services agreement for the 936-square-kilometer (360-square-mile) northwestern Alberta swath of the Duvernay known as Kaybob.

The first-stage processing plant, scheduled to start up in 2019, is to have capacity for 100 MMcf/d of natural gas and 5,000 b/d of liquid byproducts, Pembina said. According to Chevron, initial development would cover about 55,000 acres in East Kaybob under agreements with Pembina and Keyera Corp..

Chevron has a net 70% operated interest in about 330,000 acres in the Duvernay formation near Fox Creek, about 260 kilometers (162 miles) northwest of Edmonton. Three years ago Chevron sold close to one-third of its stakes in the Duvernay project to a unit of Kuwait Foreign Petroleum Exploration Co.for $1.5 billion.

Chevron has been active for generations in conventional gas drilling in the region, around Fox Creek and Grande Prairie northwest of the Alberta capital of Edmonton. Chevron, which now is using unconventional drilling techniques in the formation, issued initial results from its Duvernay program in 2013.

“We estimate these assets could deliver more than 100,000 boe/d net by the early to mid-2020s, with an investment of $8 billion,” said analysts with Tudor, Pickering, Holt & Co. of Chevron’s campaign. “Overall, economics look attractive with single well breakevens of less than $50/bbl West Texas Intermediate on attractive local condensate pricing and royalties.”

A recent earth sciences review by the Alberta Geological Survey and National Energy Board estimated Duvernay recoverable reserves at 77 Tcf of gas, 6.3 billion bbl of liquids and 3.4 billion bbl of oil.

The formation sprawls over 130,000 square kilometers of northern and central Alberta, with resource pay zones up to one kilometer (0.6 mile) thick at a depth of one to five kilometers (3,270-16,350 feet).

The reserves forecast is liable to grow as industry experience and knowledge increase, said the earth sciences agencies. Numerous producers are exploring for liquids-rich sweet spots and devising northern fracking adaptations.

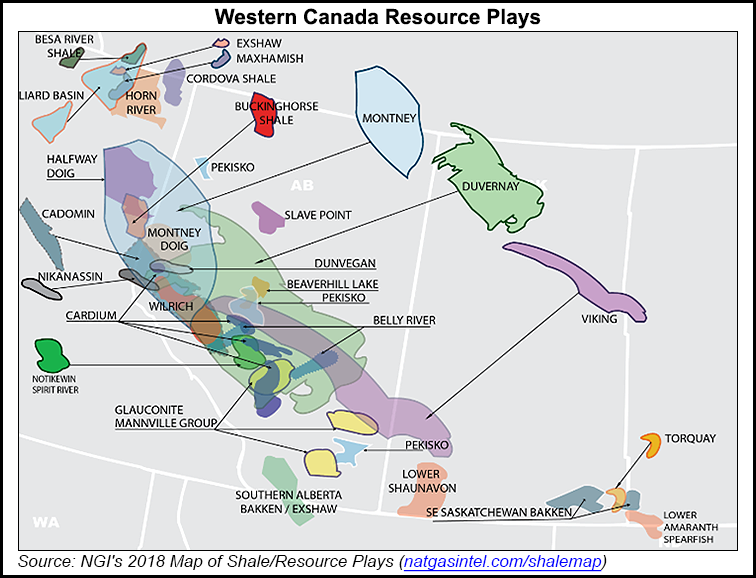

The Duvernay rates as Canada’s second-richest shale deposit after the Montney, which straddles northern British Columbia and Alberta with estimated marketable resources of 449 Tcf of gas, 14.5 billion bbl of liquids and 1.1 billion bbl of oil. Both formations are within reach of established field contractor and pipeline networks, built up by previous generations of conventional production from naturally flowing wells.

Activity to date been focused in the western part of the play by Encana Corp. and in the Central Kaybob by a unit of Royal Dutch Shell plc.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |