NGI Archives | NGI All News Access

Chevron, Cimarex Expand Delaware Basin Opportunities

Chevron Corp. will gain access to some needed infrastructure to develop a portion of its one million-acre leasehold in the Permian Basin in West Texas, and Cimarex Energy Co. will have expanded opportunities in a key Texas county under a joint agreement.

Denver-based Cimarex secured an eight-year, $60 million agreement with Chevron U.S.A. Inc. that covers 104,000 acres of leasehold in Culberson County, which would be contributed to the joint venture and operated by Cimarex. Cimarex in return would convey to Chevron a half-stake in both the Triple Crown gathering system, and the wells drilled in the joint acreage this year. Cimarex has built substantial infrastructure in its 100,000-plus acres in Culberson County; in total it has about 438,000 net acres in the Permian.

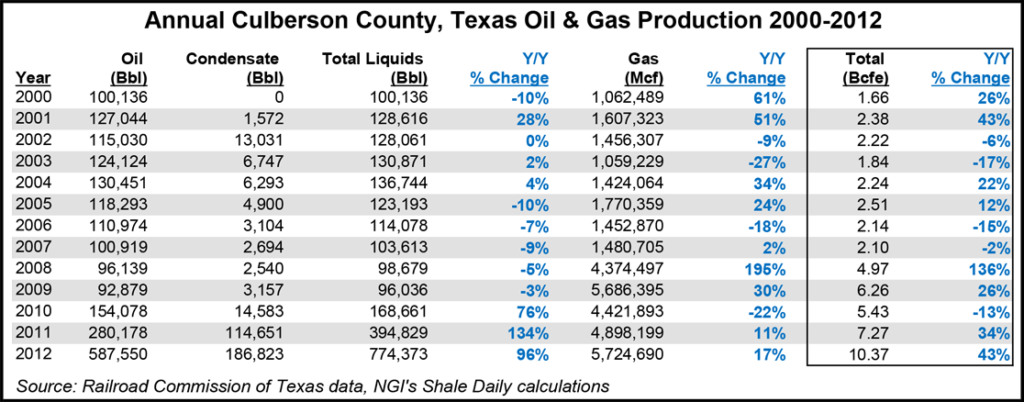

Culberson County oil and gas production has been on the rise, with the growth rate increasing dramatically over the last few years. According to Railroad Commission of Texas data, the county produced 1.66 Bcfe in 2000, 5.43 Bcfe in 2010, 7.27 Bcfe in 2011 and 10.37 Bcfe in 2012.

“This transaction builds on Chevron’s premier position in the Delaware Basin and is another step in the execution of our Permian growth strategy,” said Chevron Vice President Alan Kleier, who runs the Midcontinent business unit. “Our complementary acreage positions in West Texas and New Mexico, along with our common development outlook, make Chevron and Cimarex natural partners, and the large contiguous lease position will enable the optimum development of these resources.”

Chevron has cobbled together about one million gross acres of land in the Permian Basin through legacy positions and through recent acquisitions that include leaseholds in the Delaware Basin’s Avalon Shale and Bone Spring Sands. Last year it purchased more than 260,000 acres of additional land in the northern part of the Delaware Basin from Chesapeake Energy Corp. (see Shale Daily, Sept. 13, 2012).

The Delaware Basin in early 2012 was Chevron’s second largest unconventional acreage position for liquids after the Utica Shale (see Shale Daily, March 14, 2012).

Cimarex CEO Tom Jorden said collaborating to develop the “checkerboard” acreage “makes perfect sense. Optimal well placement for both second Bone Spring wells and longer-lateral Wolfcamp shale tests can now be achieved.”

Cimarex is one of the big players in the Delaware Basin, where it has invested heavily in saltwater disposal, electric power, roads/bridges and the Triple Crown pipeline, a 12-inch diameter pipe that runs 34 miles. Cimarex also operates the Joule-Thomson Processing Facility, with 50 MMcf/d of capacity.

Cimarex, which has long concentrated its efforts in the Permian and gassy Midcontinent, is 55% weighted to natural gas; it was producing about 661 MMcfe/d at the end of March. This year the big focus is on the multi-stacked Delaware Basin, under which lies the Bone Spring and Wolfcamp formations.

Almost two-thirds (62%) of Cimarex’s $1.5 billion capital expenditure (capex) budget this year is to go to Permian projects, with nearly all of that amount, $950 million, for the Delaware. Last year Cimarex spent about $890 million in the play.

All told, the Permian’s liquids and oil targets accounted for 42% of total production in 1Q2013, according to Vice President Mark Burford, who handles capital markets and planning. He spoke at the recent Tudor, Pickering, Holt & Co. Hotter ‘N Hell Energy Conference in Houston.

“Culberson County is emerging as a key multi-pay resource area,” Burford said of the West Texas county, which borders New Mexico.

Thirty-four of the Wolfcamp wells drilled to date in Culberson County had 30-day average initial production rates of 6.4 MMcfe/d, he said. Cimarex this year plans to use 12-14 operated rigs to punch about 115 net wells in the Permian, nearly all in the Delaware.

If Cimarex were to drill four wells per section, it would expect to recover 1.7-2.1 Tcfe, with $3.6 billion of total capital costs and a total of 500 wells, Burford said. Drilling eight wells per section would result in 3.4-4.1 Tcfe, with $7.2 billion of capex expended on 1,000 wells. The scenarios assume an estimated ultimate recovery of 5.4 Bcfe/d well at a drilling cost per well of $7.2 million.

With gains in the Permian and continued “good returns” in the Cana-Woodford Shale of Oklahoma, Cimarex expects this year’s drilling program to generate 8-13% of production growth, Burford told the audience.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |