Oklahoma City-based Chesapeake Energy Corp. on Tuesday put the Chapter 11 process in the rear-view mirror and said it wants to take up the gauntlet to develop its substantial Mother Lode of Lower 48 natural gas.

At one time the largest natural gas producer and biggest leaseholder in the onshore, Chesapeake succumbed to bankruptcy last June, and as of Tuesday had erased an estimated $7.8 billion in debt.

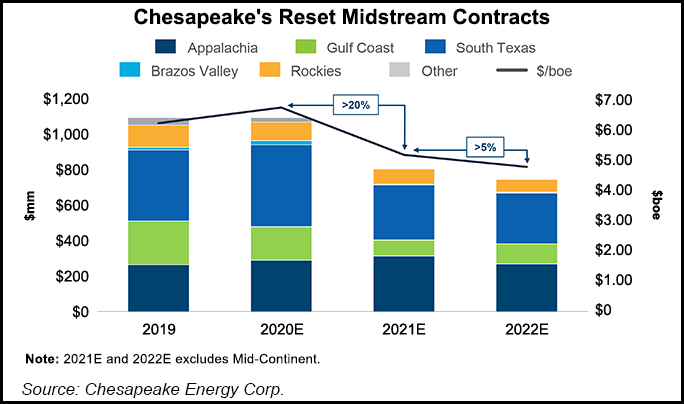

The restructuring marks a “new day,” CEO Doug Lawler said. “We have fundamentally reset our business, and with an improved capital and cost structure, disciplined approach to capital reinvestment, diverse asset base and talented employees, we are poised to deliver sustainable free cash flow for years to come.”

Chesapeake produced 435,000 boe/d on average during 4Q2020,...