NGI The Weekly Gas Market Report | Infrastructure | Markets | NGI All News Access

Changing Supply Dynamics Likely to Trap More Rockies NatGas, Say Experts

The steady supply growth that’s expected from the Appalachian Basin and Western Canada, along with rising associated output from oil-directed drilling on the Gulf Coast and Midcontinent, are poised to trap Rocky Mountain natural gas, according to speakers at a recent conference.

At the LDC Gas Forum Rockies & West conference in Broomfield, CO, last week, speakers offered a bearish assessment for Rockies supply basins. Those focused on the region are rethinking the changing supply paradigm and how the gas may be better used closer to home.

“How long have we lived begging for natural gas to be right outside the market zone, or right inside the market zone?” Tallgrass Energy Partners LP’s COO William Moler asked the audience during a presentation. “We really should be in a second industrial revolution. Natural gas today is the same price it was when I started 30 years ago…We should be using gas for electricity, for manufacturing and there’s more money in it if you do that where the natural gas is and that’s in the production zone.”

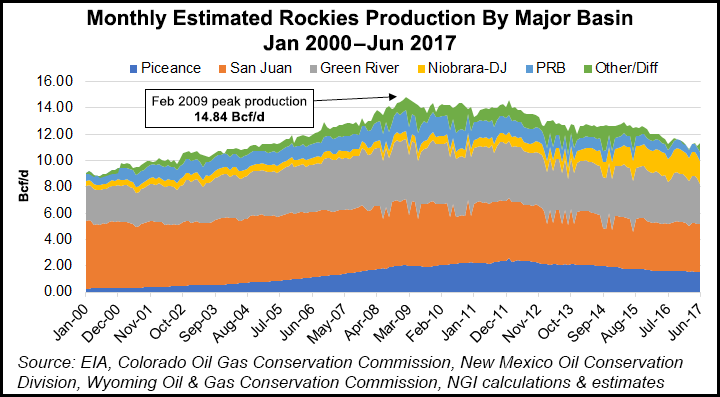

Overall Rockies production, including Colorado, Wyoming, Utah and northwestern New Mexico, peaked in February 2009 at 14.8 Bcf/d, according to NGI calculations based on Energy Information Administration and state data. Output fell to 11.4 Bcf/d by the middle of this year. The Denver-Julesburg (DJ) Basin was the only exception, rising from 590 MMcf/d to 1.77 Bcf/d over the same period.

Beat back by low-cost gas supplies from the North, East and South, ICF Managing Director Michael Sloan believes total Rockies production will continue declining by 1 Bcf/d through 2025. Meanwhile, Appalachian gas production has skyrocketed to about 25 Bcf/d. Roughly 20 Bcf/d of additional pipeline capacity will be needed to match that supply between now and 2035, said Sloan’s colleague Eric Kuhle, who is a manager in ICF’s energy advisory group.

“When you look at the Rockies, there’s not a lot of major pipeline development…We see a lot of growth in the South Atlantic, coming down from the Marcellus and Utica shales, continued expansions in the Midwest and Gulf Coast markets,” Kuhle said. We have exports driving this market in the Gulf, and the South Atlantic is being driven by the power market sector.

“You’re really not seeing any charts or arrows on the Rockies or Western Canadian side because it’s a much less dynamic market.”

Energy reforms in Mexico have driven a strong outlook for export growth to the tune of 2-2.5 Bcf/d over the next five years, Kuhle said. But he added that the Rockies aren’t likely to benefit as Mexico is closer to low-cost supplies in the Permian Basin and Eagle Ford and Haynesville shales.

The Midwest also could be a “battleground” for Rockies natural gas, but increasing supplies from the Appalachian Basin that are expected to arrive from projects like Nexus Gas Transmission or the Rover Pipeline could make the region even more competitive.

“We see an increasing share of Rockies gas supply staying in the West,” Kuhle said. “We’re looking at this [infrastructure] investment outlook and only a limited amount is focused in the Rockies and Western U.S. regions. Instead of looking at new pipelines here, you’re looking at more niche opportunities.”

That’s what Tallgrass is trying to do with the Rockies Express Pipeline (REX), which came online in 2009 and now moves 1.8 Bcf/d from west to east. In 2015, the system became bi-directional and now moves 2.6 Bcf/d from east to west. Tallgrass’ outlook — for the DJ Basin at least — is rosier, with output growing by 1.5 Bcf/d in the next three years.

“We’re still excited about the potential in the Rockies,” said REX President Crystal Heter. “We are putting a lot of focus at this point on a demand initiative. With 4.5 Bcf of gas on the pipe, we want to see it all find a home as well as getting additional gas on the line as we turn into a true header system where we’re not necessarily long-hauling gas, but coming on in shorter hauls reaching your market that’s closer.”

REX faces a contract cliff in 2019, when its agreements with the original west-to-east shippers are set to expire. But REX has renewed 40% of its mainline capacity with Encana Corp. negotiating for a term through 2024 and Ultra Petroleum Corp. having emerged from bankruptcy and signing on through 2026.

REX is in discussions with other existing shippers and Heter said she expects “good recontracting” through 2019. Tallgrass kicked-off an open season last month for the proposed 70-mile Cheyenne Connector Pipeline and the related Cheyenne Hub Enhancement project.

The pipeline has already secured long-term precedent agreements with affiliates of leading DJ producer Anadarko Petroleum Corp. and from DCP Midstream LP to move 600 MMcf/d on the Cheyenne Connector, which could come online by 3Q2019. The projects could eventually add up to 1.3 Bcf/d of capacity into REX west-to-east capacity out of the basin.

“Where is Rockies gas going to go? This isn’t a new story for us, we’ve been hearing this for years,” Heter said. “There’s a lot of speculation about Rover’s impact on Rex, we haven’t seen it yet. They’re moving 900 MMcf/d. Their capacity will be increasing. Some say they don’t think it’ll take volume off REX, some say it will. That remains to be seen and that’s an opportunity potentially for Rockies gas as well.”

REX already has 36 physical delivery points with 17.6 Bcf/d of capacity, comprised of 10 LDCs and 26 interstate pipelines.

Another opportunity is gas-fired power. The West is home to about half of the nation’s installed renewable energy capacity, and gas is being increasingly relied upon to backup variable output renewables. REX is also planning to supply three plants in the other direction in Indiana and Ohio.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |