Cash NatGas, Futures Part Ways; June Manages Modest 3-Cent Gain

Natural gas cash and futures markets forged different paths Thursday as forecasts of moderating temperatures prompted a weaker physical market, but a supportive Energy Information Administration (EIA) inventory report gave a modest lift to futures.

Major eastern population centers were expected to see high temperatures close to 20 degrees warmer, into the mid-70s, Friday, and that was enough to drop next-day quotes by double digits. Futures posted the highs of the session following the EIA report of a relatively lean 92 Bcf injection, but June failed to settle above the $3 mark. At the close, June had managed a gain of 3.4 cents to $2.949 and July was up 3.5 cents to $2.994. July crude oil jumped $1.74 to $60.72/bbl.

Following the release of the EIA inventory report, futures traders did not see an exuberant market. The June contract posted its high for the day of $3.038 immediately after the figure was released, but at the end of the day prices had skidded about 9 cents. “I think a lot of guys were caught long after the number, and I am not bullish,” said a New York floor trader.

“I think some guys are bullish, and it’s a battle in either direction. There never seems to be any follow-through. The close today was pretty weak, and anything below $2.96ish in June is pretty bearish. There is also some weird stuff going on and traders are rolling into July. I think prices are headed lower, but I’m not sure I’m in the majority. I would be a seller on rallies until we get back above July’s high at $3.081.”

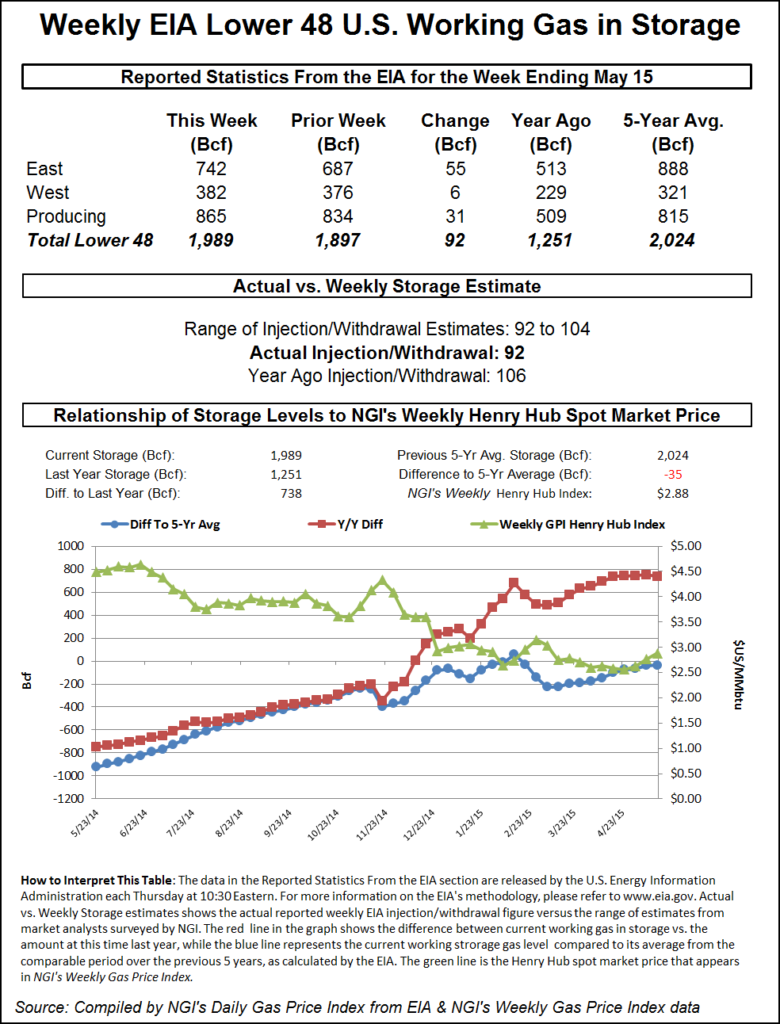

The EIA report caught a number of traders by surprise. Before the release of the data, analysts were looking for an increase closer to the upper 90 Bcf area. IAF Advisors calculated a 98 Bcf increase, and industry consultant Genscape was looking for a build of 99 Bcf. A Reuters poll of 22 traders and analysts showed an average 97 Bcf with a range of a 90 Bcf to a 107 Bcf injection.

Analyst Tim Evans of Citi Futures Perspective said the number “suggests that the background supply-demand balance continues to firm relative to where it was two to four weeks ago. We’ll need to see monthly data to confirm the source of the shift, but fading production growth and rising power sector demand remain at the top of our watch list.”

“$3 is still a pivotal area,” said a New York floor trader. “$3 is a number we need to stay above if we want to see any momentum to the upside, and we are not seeing that, basically.”

Inventories now stand at 1,989 Bcf and are 738 Bcf greater than last year and 35 Bcf less than the five-year average. In the East Region 55 Bcf was injected, and the West Region saw inventories increase by 6 Bcf. Stocks in the Producing Region rose by 31 Bcf.

Teri Viswanath, director of natural gas strategy at BNP Paribas, calculated an increase of 95 Bcf for the week ended May 15, “a level that falls far short of last year’s 106 Bcf injection. If verified, last week’s build would mark the first time this season that the storage injections have lagged year-ago levels. Thereafter, this trend (of weekly injections lagging behind last year) will likely continue as significant growth in the electric power demand sector limits restocking. Indeed, we expect that the industry will stock away 105 Bcf for the week ending May 22nd and 115 Bcf for the week ending May 29th, or a pace that falls short of last year’s 113 Bcf and 118 Bcf build, respectively.”

In spite of recent price weakness, market technicians aren’t willing to call the recent high of $3.105 a market top. “Once again, $2.949-2.908 was tested. And once again the bears failed to produce a close beneath this zone,” said Brian LaRose, a market technician at United ICAP. “As a result, we are still unable to label $3.105 as a short-term top. Bears need to take out Wednesday’s low [$2.902] to trigger a deeper correction of the $2.443 to 3.105 advance. Bulls need to push through $3.105 to signal the trend is still up.”

In physical trading, next-day gas weakened as temperatures in eastern metropolitan area were expected to be more seasonal. Forecaster AccuWeather.com predicted that the high in New York City Thursday of 62 degrees would jump to 75 Friday before sliding to 69 on Saturday. The normal high in New York this time of year is 73. Philadelphia’s Friday Thursday high of 58 was seen climbing to 76 Friday and retreating to 71 on Saturday. The normal high in Philadelphia in late May is 76.

Gas for delivery Friday on Millennium fell 21 cents to $1.35, and gas on Iroquois Waddington was down a penny at $3.06. Packages on Tennessee Zone 6 200 L tumbled 83 cents to $2.21.

In the Mid-Atlantic gas bound for New York City on Transco Zone 6 fell 47 cents to $2.12, and parcels on Tetco M-3 changed hands at $1.55, down 7 cents.

An industry pipeline veteran commented that “LDCs aren’t taking any gas, so it’s all going to the power plants. The plants can only take as much as they can, and they are somewhat limited as there is maintenance work that will have impact on some of their suppliers to deliver. It could be a little treacherous at times, but we should be all right.”

Producing zones also felt the impact of a softer market as well as gas at Rocky Mountain locations weakened. Gas at the Cheyenne Hub fell 4 cents to $2.73, and deliveries to CIG Mainline slipped 2 cents to $2.69. Gas at the Opal Plant tailgate fell 4 cents to $2.72, and gas on Northwest Pipeline WY shed 5 cents to $2.66.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |